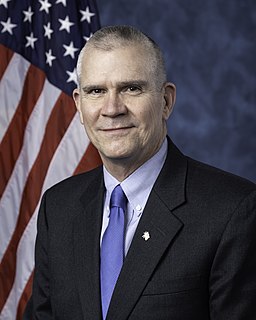

A Quote by Warren Stephens

Owning equities is an essential part of anyone's portfolio. You just can't ignore it over time. It's going to add the real pop to anyone's overall performance.

Related Quotes

There is one thing of which I can assure you. If good performance of the fund is even a minor objective, any portfolio encompassing one hundred stocks (whether the manager is handling one thousand dollars or one billion dollars) is not being operated logically. The addition of the one hundredth stock simply can't reduce the potential variance in portfolio performance sufficiently to compensate for the negative effect its inclusion has on the overall portfolio expectation.

It's quite clear that stocks are cheaper than bonds. I can't imagine anybody having bonds in their portfolio when they can own equities, a diversified group of equities. But people do because they, the lack of confidence. But that's what makes for the attractive prices. If they had their confidence back, they wouldn't be selling at these prices. And believe me, it will come back over time.

We make it easy for anyone to get free resources. Anyone can launch an idea for five minutes. Anyone can comment on, add, and enhance the idea. Need a designer? We provide an entrepreneurial matching system without the bosses getting involved. And in terms of unstructured time, we have a permission for that.