A Quote by Whitney Tilson

I'd say the general outline of a sound investment approach is, first of all, you have to decide are you going to try to be an investor yourself? The answer for most people is probably they shouldn't try. You should put your money in index funds and not try to be a stock picker.

Related Quotes

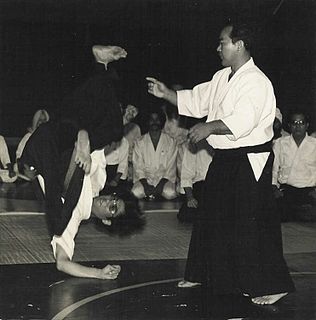

Even if a hundred ton boulder should fall, I would be safe! When I say this, everyone laughs and wonders how. No need to try to stop it, just move out of the way. You do not have a problem if you do not try to take it on yourself. Most people suffer because they try to take upon themselves things which they do not need to.

Be as honest with yourself as possible, and try to make friends with people who like you for you - not an iteration of who you are, or who you think you should be - but really like you for you. And when you're creating whatever you want to do in your life, just try to create and put out the truest version of yourself into the world.

J.P. Morgan once had a friend who was so worried about his stock holdings that he could not sleep at night. The friend asked, 'What should I do about my stocks?' Morgan replied, 'Sell down to your sleeping point' Every investor must decide the trade-off he or she is willing to make between eating well and sleeping well. High investment rewards can only be achieved at the cost of substantial risk-taking. So what is your sleeping point? Finding the answer to this question is one of the most important investment steps you must take.

And what I'm telling you now is not for you to go out and try the same ways I try, or not to even try my technique. Just put it to your personality, put it to yourself, and you develop your workout. Cause those books and things, those are other people's gimmicks and hypes. Build your own gimmick and hype, and that'll make you a better powerlifter. Not just doin' it like James does it, cause if you try to fly off the building like superman you'll be out there in the middle of the street.

My general approach to writing fiction is that you try to have as few conceptual notions as possible and you just respond to the energy that the story is making rather than having a big over plan. I think if you have a big over plan, the danger is that you might just take your plan and then you bore everybody. I always joke that it's like going on a date with index cards. You know, at 7:30 p.m. I should ask about her mother. You keep all the control to yourself but you are kind of insulting to the other person.

We are seeing a lot of cases where the startups are writing the term sheet, dictating the terms, selling common stock instead of preferred stock, where they don't give the investor veto rights or board seat or privileges, and they are really asking the investor -- why should I take your money when there is other money available.

While it is probably a poor idea to own actively managed funds in general, it is truly a terrible idea to own them in taxable accounts... taxes are a drag on performance of up to 4 percentage points each year... many index funds allow your capital gains to grow largely undisturbed until you sell... For the taxable investor, indexing means never having to say you're sorry.

The idea that you try to time purchases based on what you think business is going to do in the next year or two, I think that's the greatest mistake that investors make because it's always uncertain. People say it's a time of uncertainty. It was uncertain on September 10th, 2001, people just didn't know it. It's uncertain every single day. So take uncertainty as part of being involved in investment at all. But uncertainty can be your friend. I mean, when people are scared, they pay less for things. We try to price. We don't try to time at all.

I think that when you put yourself, as actors have to do, in other people's shoes, when you have to put on the costume that someone else has worn in their life, it gets much, much harder to be prejudiced against them and even to be - to not try to look at the world in a sense of "I'm not going to judge somebody. I'm going to try to understand who they are and what they're about."