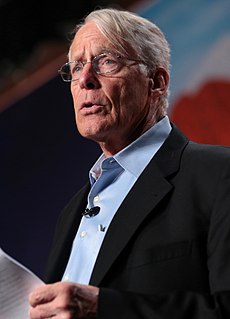

A Quote by Whitney Tilson

Nirvana, to a value investor, is paying a cheap price for a company that is growing in value every year at a nice rate - this largely explains why today we own stocks like Berkshire Hathaway, McDonald's, Wal-Mart, Microsoft, Costco and Anheuser-Busch.

Related Quotes

We take the traditional value investor's process and just flip it around a little bit. The traditional value investor asks 'Is this cheap?' and then 'Why is it cheap?' We start by identifying a reason something might be mispriced, and then if we find a reason why something is likely mispriced, then we make a determination whether it's cheap.

Every business tries to turn this year's success into next year's greater success. It's hard for me to see why Microsoft is sinful to do this. If it's a sin, then I hope all of Berkshire Hathaway's subsidiaries are sinners. Someone whose salary is paid by U.S.taxpayers is happy to dramatically weaken the one place where we're winning big?!

Berkshire has the lowest turnover of any major company in the U.S.The Walton family owns more of Wal-Mart than Buffett owns of Berkshire, so it isn't because of large holdings. It's because we have a really unusual shareholder body that thinks of itself as owners and not holders of little pieces of paper.

I LOVE WAL-MART. I CONSIDER MY JOKES TO BE VERY JEUVINILLE. STUFF A 14 YEAR OLD WOULD LAUGH AT BECAUSE THATS THE SENCE OF HUMOR I HAVE. ALL THE STUFF I TALK ABOUT MAY NOT BE APPROPRIATE FOR CHURCH GROUPS HOWEVER WAL-MART AINT SUNDAY SCHOOL. AS LONG AS I DIDNT USE OFFENSIVE FOUL LANGUAGE I KNEW ID BE FINE. WAL-MART GETS IT, THATS WHY THEY BLOW AWAY THE COMPETITION. BESIDES ITS THERE STORE THEY CAN DO WHAT THEY WANT. THATS AMERICA BABY!

Value in relation to price, not price alone, must determine your investment decisions. If you look to Mr Market as a creator of investment opportunities (where price departs from underlying value), you have the makings of a value investor. If you insist on looking to Mr Market for investment guidance however, you are probably best advised to hire someone else to manage your money.

Wal-Mart has become the whipping boy for political demagogues, unions and anti-traders. I suggest that they have the wrong target.... Wal-Mart exists and prospers because tens of millions of Americans find Wal-Mart to be a suitable source of goods and services..... unions and anti-traders should direct their outrage and condemnation at the tens of millions of Americans who shop at Wal-Mart and keep it in business.