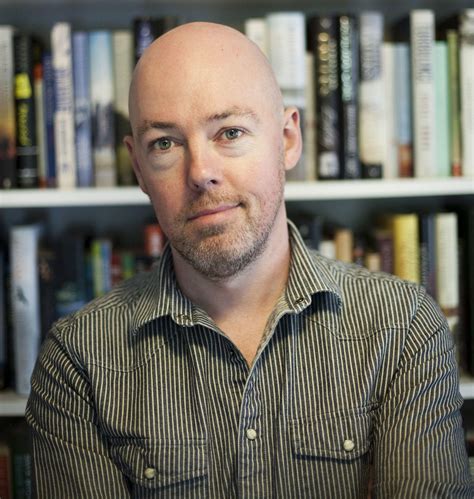

A Quote by Whitney Tilson

The exact details of how you practice value investing will vary investor to investor, but the fundamental principle of scouring the world, looking for dollar bills that you can buy for 50 cents or at some big discount - that is universal to value investing.

Related Quotes

When we do an investment, we always ask, 'Can we affect the outcome? When buying a company, can we have an impact?' That's a different style of investing than a passive investor in the stock market. To me, that's how you're taking the risk out of it. You know what your capability is and how you can enhance value.

An outstanding addition to the volumes written on value investing. Not only do the authors offer their own valuable insights but they have provided in one publication invaluable insights from some of the most accomplished professionals in the investment business. I would call this publication a must-read for any serious investor.

Utilities used deregulation to effect a series of mergers limiting competition. In order to accelerate profits, cost cutting ensued, involving the layoff of thousands of utility company employees, including some who were responsible for maintenance of generation, transmission, and distribution systems. A number of investor-owned utilities stopped investing in the maintenance and repair of their own equipment, and, instead, cut costs to enhance the value of their stock rather than spending money to enhance the value of their service.

The value of a dollar is to buy just things; a dollar goes on increasing in value with all the genius and all the virtue of the world. A dollar in a university is worth more than a dollar in a jail; in a temperate, schooled, law-abiding community than in some sink of crime, where dice, knives, and arsenic are in constant play.

The investor has the benefit of the stock market's daily and changing appraisal of his holdings, 'for whatever that appraisal may be worth', and, second, that the investor is able to increase or decrease his investment at the market's daily figure - 'if he chooses'. Thus the existence of a quoted market gives the investor certain options which he does not have if his security is unquoted. But it does not impose the current quotation on an investor who prefers to take his idea of value from some other source.

[W]e think the very term 'value investing' is redundant. What is 'investing' if it is not the act of seeking value at least sufficient to justify the amount paid? Consciously paying more for a stock than its calculated value -- in the hope that it can soon be sold for a still-higher price -- should be labeled speculation (which is neither illegal, immoral nor -- in our view -- financially fattening).

Gold has intrinsic value. The problem with the dollar is it has no intrinsic value. And if the Federal Reserve is going to spend trillions of them to buy up all these bad mortgages and all other kinds of bad debt, the dollar is going to lose all of its value. Gold will store its value, and you'll always be able to buy more food with your gold.