A Quote by Wilbur Ross

I see myself as a private-equity investor that helps rebuild companies. Restructuring is a cottage industry in that there aren't that many serious practitioners.

Related Quotes

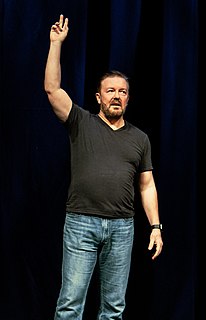

Being a good private equity investor is more complicated than it seems. I would say that there are a few characteristics that are important. If you look at the skill set that you need to ultimately be a successful private equity investor, at least at the senior level, you have to be, in this business, a good investor. You have to be able to help companies perform and you have to have judgment around exiting investments. If you look at the skill sets there, they include some things you can teach and some that you can't.

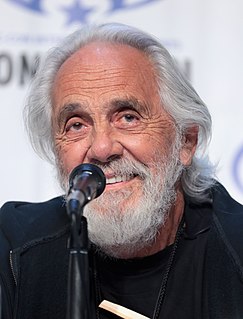

By making marijuana illegal, the agricultural people can't grab hold of it like they did with corn and wheat. So those companies are scrambling around trying to get hold of it, but they can't, because it's a cottage industry, and it will always be a cottage industry. Because the minute the big companies try to make it their own, like they did with soybeans...like Monsanto, they put their own patent on seeds, and you can't do that with marijuana.

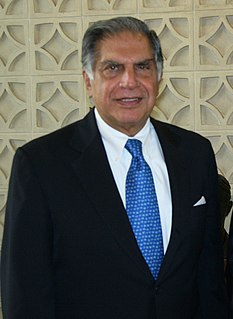

One of the weaknesses of Indian industry is that in many areas.. like consumer goods.. it is very fragmented. Individually, the companies might not be able to survive. What is needed is a consortium of like companies in one industry, presenting a strong front to the multinationals. The Swiss watch industry did this.

I believe that we will see a lot of destruction, but I believe that if we can see the right patterns and draw the right lessons from that destruction, we might be able to rebuild before it's too late. And then I have that ultimate optimism that even if we can't, life will rebuild itself. In a way, the global economy might collapse, but Gaia won't, and people's ingenuity won't. We will rebuild society, we will rebuild local economies, we will rebuild human aspirations.