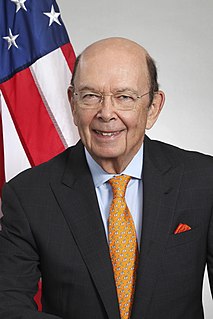

A Quote by Wilbur Ross

Washington, D.C., is the new Wall Street. No significant financial transaction of any consequence occurs without it.

Quote Topics

Related Quotes

I got all the respect in the world for the front-runners in this race, but ask yourself: If we replace a Democratic insider with a Republican insider, you think we're really going to change Washington, D.C.? You don't have to settle for Washington and Wall Street insiders who supported the Wall Street bailout and the Obamacare individual mandate.

Tax the rich. End the wars. Break the power of lobbies in Washington. These are the demands of Occupy Wall Street. They are very important. The US corporations dominate Washington. The big oil companies, Wall Street banks and the military-industrial complex - they rule this country and their influence and power has to be broken.

When we look at government in Washington or what's happening on Wall Street, we see so much centralization. But really, our goals should be to eliminate and overcome these central institutions. And in recent years we have gained powerful new tools to do this, and most significant among those is the block chain, which is the software behind Bitcoin.

I think the money for the solutions for global poverty is on Wall Street. Wall Street allocates capital. And we need to get capital to the ideas that are successful, whether it's microfinance, whether it's through financial literacy programs, Wall Street can be the engine that makes capital get to the people who need it.

Once again, the puppets on Capitol Hill are about to slam the Muppets on Main Street. The country still hasn't recovered from the Wall Street-induced financial cataclysm of 2008, yet Congress is preparing to enact the Orwellian 'JOBS Act' - a bill that should in fact be called the 'Return Fraud to Wall Street in One Easy Step Act.'

Whatever happens in Washington, Wall Street, Hollywood or Silicon Vally in the next ten years, it will be irrelevant if our families don't come together at a much higher level. Without a renaissance of family, no new candidate can rise to save us. No new legislation, policy or program will heal our land.

The whole financial structure of Wall Street seems to rise or fall on the mere fact that the Federal Reserve Bank raises or lowers the amount of interest. Any business that can't survive a one percent change must be skating on thin ice.

Why even the poor farmer took a raise of another ten percent just to get a loan from the bank, and nobody from the government paid any attention. But you let Wall Street have a nightmare and the whole country has to help to get them back into bed again.