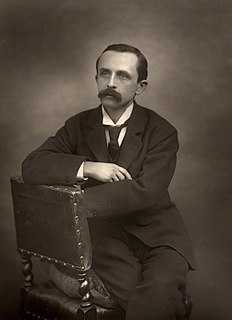

A Quote by Wilbur Ross

There are deep value opportunities in insurance stocks, which were beaten down because of their exposure to the subprime crisis, annuities, and commercial real estate.

Related Quotes

Mr. Darling used to boast to Wendy that her mother not only loved him but respected him. He was one of those deep ones who know about stocks and shares. Of course no one really knows, but he quite seemed to know, and he often said stocks were up and shares were down in a way that would have made any woman respect him.

Value investors will not invest in businesses that they cannot readily understand or ones they find excessively risky. Hence few value investors will own the shares of technology companies. Many also shun commercial banks, which they consider to have unanalyzable assets, as well as property and casualty insurance companies, which have both unanalyzable assets and liabilities.

We sometimes emphasize the danger in a crisis without focusing on the opportunities that are there. We should feel a great sense of urgency because it is the most dangerous crisis we have ever faced, by far. But it also provides us with opportunities to do a lot of things we ought to be doing for other reasons anyway. And to solve this crisis we can develop a shared sense of moral purpose.