A Quote by Will Rogers

If a bank fails in China, they behead the men at the top of it that was responsible... If we beheaded all of ours that were responsible for bank failures, we wouldn't have enough people left to bury the heads.

Related Quotes

As a matter of fact 25% of our U.S. investment banking business comes out of our commercial bank. So it's a competitive advantage for both the investment bank - which gets a huge volume of business - and the commercial bank because the commercial bank can walk into a company and say, "Oh, if you need X, Y and Z in Japan or China, we can do that for you."

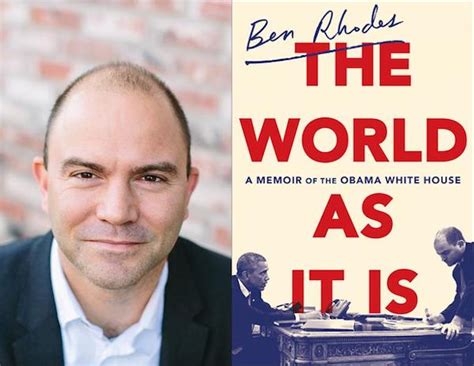

There's this constant narrative of anxieties: Is the U.S. in decline? Is China rising? People forget... no other country is trying to play the role we play. They're not signing up to be responsible for security in the Middle East, responsible for the global economy, responsible for enforcing international norms.

So: if the chronic inflation undergone by Americans, and in almost every other country, is caused by the continuing creation of new money, and if in each country its governmental "Central Bank" (in the United States, the Federal Reserve) is the sole monopoly source and creator of all money, who then is responsible for the blight of inflation? Who except the very institution that is solely empowered to create money, that is, the Fed (and the Bank of England, and the Bank of Italy, and other central banks) itself?

We begin to change the dynamic of our relationships as we are able to share our reactions to others without holding them responsible for causing our feelings, and without blaming ourselves for the reactions that other people have in response to our choices & actions. We are responsible for our own behavior and we are not responsible for other people's reactions; nor are they responsible for ours.

The federal [bank deposit] insurance scheme has worked up to now simply and solely because there have been very few bank failures. The next time we have a pestilence of them it will come to grief quickly enough, and if the good banks escape ruin with the bad ones it will be only because the taxpayer foots the bill.

The Depression, which started in 1929 was rather mild from 1929 to 1930. And, indeed, in my opinion would have been over in 1931 at the latest had it not been that the Federal Reserve followed a policy which led to bank failures, widespread bank failures, and led to a reduction in the quantity of money.

What we've done last night is what I call pushing back the risks..If there is a risk in a bank, our first question should be 'Okay, what are you in the bank going to do about that? What can you do to recapitalise yourself? If the bank can't do it, then we'll talk to the shareholders and the bondholders, we'll ask them to contribute in recapitalising the bank, and if necessary the uninsured deposit holders.

It's responsible for the sloppiness and imprecision of the War on Terror, for example. It's responsible for taking people's tax dollars and spending the country into debt on useless wars and pointless pork projects to buy votes. It's responsible for bailing out the banks instead of standing up for the people the banks cheated. It's responsible for plenty.