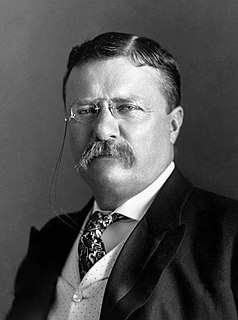

A Quote by Will Rogers

They have passed the big inheritance tax, and that gets you when you are gone. You used to could die and be able to beat taxes, but not now. The undertaker don't go over your body as carefully as the assessor does your accumilated assets, and he gets his before the undertaker. They have it on these big fortunes now where they pay as high as 60 to 70 percent of what they leave. That's mighty expensive dying when it runs into money like that, and you won't see 'em dropping off as casually as they have been.

Related Quotes

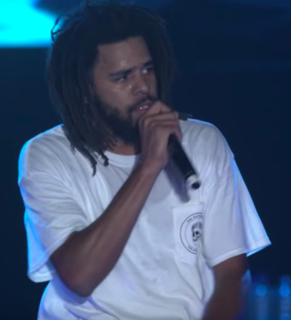

When you're a producer on top of that, just havin' a beat that's hot is not enough. Now you know your sound, 'cause you've been workin' on your sound for so long, and now you're extra picky. You might do a beat that's ill, that the average rapper would pay big money to get on, but you don't wanna do it because you're like, "Ehhh... it's not what I'm looking for, it's not what I'm goin' for." So you're extra picky.

When you say the tax system benefits the rich, there are a lot of people who respond, "That can't be true, look at the rate of tax. The people who are rich pay a higher rate than you or I." Well, yeah, but if you don't have to pay taxes on a lot of your income, then your real tax rate is a lot lower. And if you're allowed to pay your taxes thirty years from now instead of today then you're a lot better off. People need to have a sophisticated understanding of how the system works to appreciate that the posted tax rate really has very little to do with the taxes people pay.

Texas has no income tax, which is a big draw for corporate executives who do business there. But it's hardly tax-free. The property taxes are high for a Southern state. The sales taxes are high. One study found that the bottom 20 percent of the Texas population pays 12 percent of its income in state and local taxes.

Senior executives can, after a fashion, get a portion of their pay tax-free. You defer part of your income and not have to pay taxes on it, and then when you retire you have the company buy a life insurance policy on you using that money. The company can deduct that money because it is a business expense, and the money will get paid out to your children or grandchildren when you die, so you have effectively given them your money and it's never been taxed.

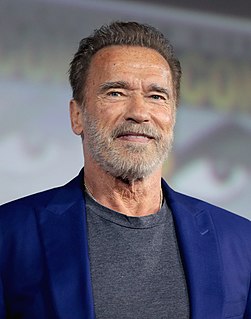

The big thing that's happened is, in the time since the Affordable Care Act has been going on, our medical science has been advancing. We have now genomic data. We have the power of big data about what your living patterns are, what's happening in your body. Even your smartphone can collect data about your walking or your pulse or other things that could be incredibly meaningful in being able to predict whether you have disease coming in the future and help avert those problems.

Politicians like to talk about the income tax when they talk about overtaxing the rich, but the income tax is just one part of the total tax system. There are sales taxes, Medicare taxes, social security taxes, unemployment taxes, gasoline taxes, excise taxes - and when you add up all of those taxes [many of which are quite regressive], and then you look at how they affect the rich and the poor, you essentially end up with a system in which the best off 20 percent of Americans pay one percentage point more of their income than the worst off 20 percent of Americans.

Would your reply possibly be this? Well, it all depends on what my tax rate will be on the gain you're saying we're going to make. If the taxes are too high, I would rather leave the money in my savings account, earning a quarter of 1 percent. Only in Grover Norquist's imagination does such a response exist.

You, as a wage earner have to pay your taxes every year on your income for that year. So if you have a one-time windfall that makes you a lot money you could end up in the top tax bracket. But if you're a corporation you are allowed to reach forward with deferrals for years. Over a 45 to 50 year period, you can balance out the winning years and the losing years in such a way that you pay very little tax, especially considering the time-value of the money.