A Quote by Will Rogers

Wall Street is being investigated, but they are not asleep while it's being done. You see where the Senate took that tax off the sales of stocks, didn't you? Saved 'em $48,000,000. Now, why don't somebody investigate the Senate and see who got to them to get that tax removed? That would be a real investigation.

Related Quotes

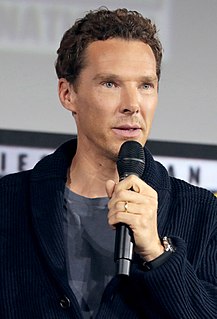

When you consider that a steelworker who's making $40,000 a year has virtually the same tax burden as someone who's making $400,000 a year, you see that there are inequities. This administration has used the tax code to accelerate wealth to the top. Most of the tax breaks have gone to people in the top bracket.

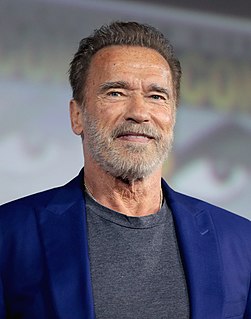

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

God forbid that the United Kingdom should take a lead and introduce a sensible tax system of its own which would probably comprise a very low level of corporation tax - tax on corporate profits - and perhaps a low level of corporate sales tax, because sales are where they are, and sales in this country are sales here, which we can tax here.

We need to enact fundamental tax reform. The weight and complexity of our 73,000-page tax code are crushing everyday Americans. We need to radically simplify the tax code so that we can re-start the real engine of growth in our economy. That means our tax code needs to go from 73,000 pages down to about three pages.

It is easier to start taxes than to stop them. A tax an inch long can easily become a yard long. That has been the history of the income tax. Would not the sales tax be likely to have a similar history [in the U.S.]? ... Canadian newspapers report that an increase in the sales tax threatens to drive the Mackenzie King administration out of office. Canada began with a sales tax of 2%.... Starting this month the tax is 6%. The burden, in other words, has already been increased 200% ... What the U.S. needs is not new taxes, is not more taxes, but fewer and lower taxes.

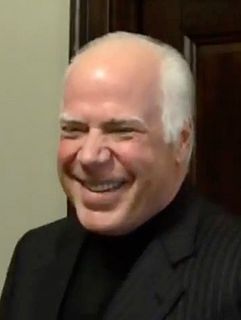

The day after Republicans won solid majorities in the House and Senate, House Speaker John Boehner and Senate Majority Leader-to-be Mitch McConnell outlined priorities for the newly elected Congress. High on the list is fundamental tax reform. In addition to overhauling the federal tax code, however, Congress should rein in the Internal Revenue Service.

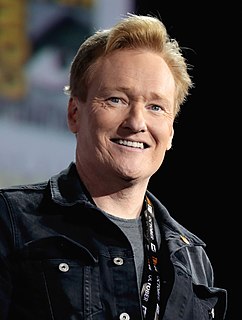

If I get married I get a tax break, if I have a kid I get a tax break, if I get a mortgage I get a tax break. I don't have any kids and I drive a hybrid, I think I should get a tax break. I'm trying to pay off my apartment so I have something tangible. I actually figured out if I paid off my place my reward would be that I would pay an extra four grand a year in taxes.