A Quote by Will Rogers

Don't gamble; take all your savings and buy some good stock and hold it till it goes up, then sell it. If it don't go up, don't buy it.

Related Quotes

Here’s how to know if you have the makeup to be an investor. How would you handle the following situation? Let’s say you own a Procter & Gamble in your portfolio and the stock price goes down by half. Do you like it better? If it falls in half, do you reinvest dividends? Do you take cash out of savings to buy more? If you have the confidence to do that, then you’re an investor. If you don’t, you’re not an investor, you’re a speculator, and you shouldn’t be in the stock market in the first place.

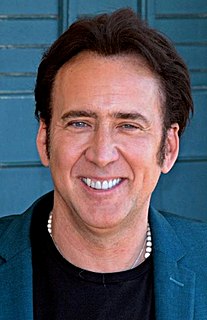

Some things I won't do for any amount of money. That's so demoralizing and goes against every principle that I hold. It's like, okay, some rich people can buy me because I'm a talented guy. They can buy talent. You can't buy it for yourself, but you can buy other people's talent to serve your purposes. And once an artist does that, he becomes like a plaything of the rich. You know, some of these wealthy collectors have paid lots of money for artwork that I already did, but I didn't do it with the intention of catering to them.

You're sad because you're sad. It's psychic. It's the age. It's chemical. Go see a shrink or take a pill, or hug your sadness like an eyeless doll you need to sleep. Well, all children are sad but some get over it. Count your blessings. Better than that, buy a hat. Buy a coat or a pet. Take up dancing to forget.

Don't try to buy art as an investment. Buy something you really love because you're going to have to look at it again tomorrow. And an investment can go up or down. Buy something you really adore, you really like, and you want to live with. And if you decide some years later you don't want to live with it anymore, sell it. Get out.

Allowing short selling is allowing people to sell - instead of having to buy the stock and then sell it, which doesn't do much; allow them to sell it, and then buy it. In which case they can express that information and the idea is that you would get more accurate valuation of companies by letting people express both their positive information and their negative information through either long or short selling.

When you buy enough stocks to give you control of a target company, that's called mergers and acquisitions or corporate raiding. Hedge funds have been doing this, as well as corporate financial managers. With borrowed money you can take over or raid a foreign company too. So, you're having a monopolistic consolidation process that's pushed up the market, because in order to buy a company or arrange a merger, you have to offer more than the going stock-market price. You have to convince existing holders of a stock to sell out to you by paying them more than they'd otherwise get.