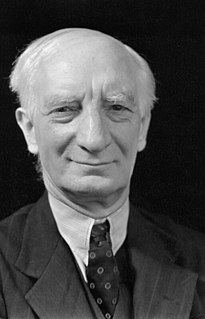

A Quote by William Beveridge

There is no inherent mechanism in our present system which can with certainty prevent competitive sectional bargaining for wages from setting up a vicious spiral of rising prices under full employment.

Related Quotes

Collective bargaining has always been the bedrock of the American labor movement. I hope that you will continue to anchor your movement to this foundation. Free collective bargaining is good for the entire Nation. In my view, it is the only alternative to State regulation of wages and prices - a path which leads far down the grim road of totalitarianism. Those who would destroy or further limit the rights of organized labor - those who would cripple collective bargaining or prevent organization of the unorganized - do a disservice to the cause of democracy.

The American people have no idea they are paying the bill. They know that someone is stealing their hubcaps, but they think it is the greedy businessman who raises prices or the selfish laborer who demands higher wages or the unworthy farmer who demands too much for his crop or the wealthy foreigner who bids up our prices. They do not realize that these groups also are victimized by a monetary system which is constantly being eroded in value by and through the Federal Reserve System.

The greatest danger to an adequate old-age security plan is rising prices. A rise of 2% a year in prices would cut the purchasing power of pensions about 45% in 30 years. The greatest danger of rising prices is from wages rising faster than output per man-hour.... Whether the nation succeeds in providing adequate security for retired workers depends in large measure upon the wage policies of trade unions.

Initially, QE contributed to a pretty significant increase in inequality. It raised asset prices, which are owned primarily by the wealthy, while having relatively small if any positive impacts on bank lending, employment, wages or economic growth, so ordinary people haven't had much help. By the third round of QE in 2012-2014, the effects had likely muted quite a bit. There were probably not big impacts on asset prices from QE and the positive effects on employment growth might have strengthened somewhat.

We try to prevent the creation of artificial rents. Rather than setting up quotas to stop imports we levy a tariff, that would be better. Or we pay wages in the public sector which are roughly equivalent to the productivity in the private sector and we don't therefore make it a special benefit to get a bureaucratic position.

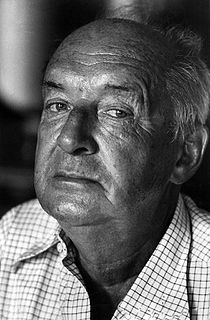

Kalecki thus precisely predicted the economic and political U-turn that occurred with the advent of neoliberalism. Kalecki also argued that fundamental institutional changes, especially regarding wage-setting and other aspects of the employment relationship, would be essential if full employment was to be sustained.