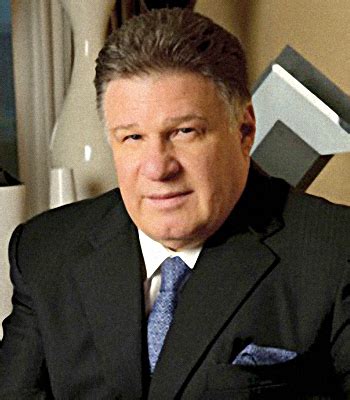

A Quote by William C. Brown

Money management is the only strategy to survive in this crazy, stupid and doped financial world market.

Quote Topics

Related Quotes

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

It's really an interesting crazy world where like ultimately you have to work your ass off and sacrifice a lot in your life and the end goal is personal and financial gain. You know, it's not like you're doing anything helpful to the world. You're really just trying to get ahead and to beat out the next person and to be on top and at the very top of those financial firms, like the people that make the crazy amounts of money I mean that's what their after.

The rich does not work for money, but money work for them...., While the poor work for money.Illiteracy, both in word and numbers, is the foundation of financial struggle....,Wealth is a person's ability to survive so many number of days forward... or if i stopped working today, how could i survive?...,Wealth is the measure of cash flow from to asset column compared with the expense column.

Good money management alone isn't going to increase your edge at all. If your system isn't any good, you're still going to lose money, no matter how effective your money management rules are. But if you have an approach that makes money, then money management can make the difference between success and failure.

Why, just a couple of economic seasons ago, was idle cash considered an indication of bad management or lazy management? Because it meant that management didn't have this money out at work ... Now look. Presto! A new fashion! Cash is back in! Denigrating liquidity has dropped quicker than hemlines. A management is now saluted if it has some cash, some liquidity, doesn't have to go to the money market at huge interest rates to get the wherewithal to keep going and growing. Along with Ben Franklin, my father and your father would understand and applaud this new economic fashion.

The single most damaging misconception about strategy is that it is a set of financial performance goals. The so-called "strategies" created by many managements are nothing more than three-to-five year financial performance forecasts. They are then labeled "strategy" and shipped off to the board of directors which goes through the motions of discussing how big the numbers are. Strategy is not your aspirations. Strategy is concerned with how you will arrange your actions and resources to punch through the challenges you face.

One of the great things about a free market is that it's inherently and indefatigably Darwinistic. Left to its own devices, a free market will eventually weed out the stupid from both 'ends' of the food chain otherwise described as supply and demand. As money is liberated from the hands of the stupid, those who would sell products or services to the stupid will eventually lose their share of the marketplace. Devoid of any 'benevolent' interference from government, the process is gloriously relentless, and cannot help but yield a successively smarter class of participants.

When I joined I was young and silly and made some very stupid decisions, being oblivious to the magnitude of the consequences. I did go a little crazy after Musafir. There was plenty of money and adulation and I would see guys going crazy for me. The songs were a big hit and it was like living the life one only dreams of.

In my opinion, the greatest misconception about the market is the idea that if you buy and hold stocks for long periods of time, you'll always make money. Let me give you some specific examples. Anyone who bought the stock market at any time between the 1896 low and the 1932 low would have lost money. In other words, there's a 36 year period in which a buy-and-hold strategy would have lost money. As a more modern example, anyone who bought the market at any time between the 1962 low and the 1974 low would have lost money.

It is crucial to have a strategy in place before problems hit, precisely because no one can accurately predict the future direction of the stock market or economy. Value investing, the strategy of buying stocks at an appreciable discount from the value of the underlying businesses, is one strategy that provides a road map to successfully navigate not only through good times but also through turmoil.