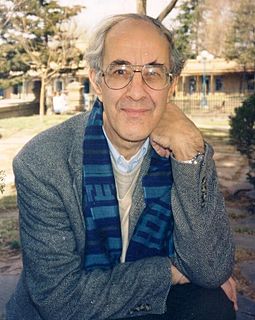

A Quote by William Eckhardt

If the losses don't hurt, your financial survival is tenuous.

Related Quotes

The people who survive avoid snowball scenarios in which bad trades cause them to become emotionally destabilized and make more bad trades. They are also able to feel the pain of losing. If you don't feel the pain of a loss, then you're in the same position as those unfortunate people who have no pain sensors. If they leave their hand on a hot stove, it will burn off. There is no way to survive in the world without pain. Similarly, in the markets, if the losses don't hurt, your financial survival is tenuous.

In a crisis, stocks of financial companies are great investments, because the tide is bound to turn. Massive losses on bad loans and soured investments are irrelevant to value; improving trends and future prospects are what matter, regardless of whether profits will have to be used to cover loan losses and equity shortfalls for years to come.

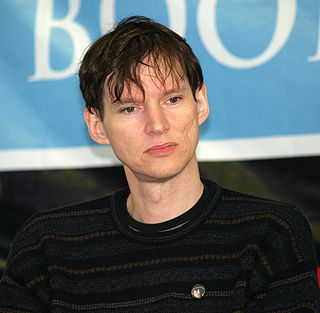

Singing what's in your heart? Naming the things you love and loathe? You can get hurt that way. Hell, you will get hurt that way. But you'll get hurt trying to hide away in all that silence and leave your life unsung. There's no future without tears. Are you really setting your hopes on not getting hurt at all? You think that's an option? You clearly aren't listening to enough Morrissey songs.

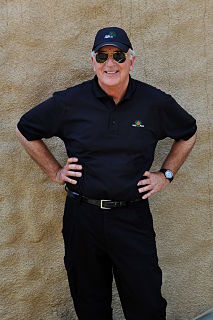

Our greatest theoretical physicist, Stephen Hawking, recently declared that humans have no more than a hundred years to get off this planet to ensure the survival of our species. And when someone such as he does so, it is with an understanding not just of the science, but of both our tenuous place and our possibility in the universe.