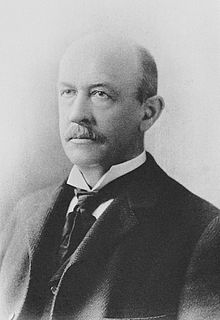

A Quote by William Graham Sumner

The waste of capital, in proportion to the total capital, in this country between 1800 and 1850, in the attempts which were made to establish means of communication and transportation, was enormous.

Related Quotes

Thus, the capital owner is not a parasite or a rentier but a worker - a capital worker. A distinction between labor work and capital work suggests the lines along which we could develop economic institutions capable of dealing with increasingly capital-intensive production, as our present institutions cannot.

If surface water can be compared with interest income, and non-renewable groundwater with capital, then much of the West was living mainly on interest income. California was milking interest and capital in about equal proportion. The plains states, however, were devouring capital as a gang of spendthrift heirs might squander a great capitalist's fortune.

If, for example, each of us had the same share of capital in the national total capital, then if the share of capital goes up it's not a problem, because you get as much as I do. The problem is that capital in capitalist countries is very heavily concentrated, especially financial capital. So then if the share of income from that source goes up, that actually exacerbates inequality.

I admit that one should never underestimate the capacity of banks to destroy enormous amounts of accumulated capital and reduce, temporarily, the supply. After all, capital is the accumulated savings of mankind. And banks are great masters in destroying enormous amounts of capital with great regularity.

The financial doctrines so zealously followed by American companies might help optimize capital when it is scarce. But capital is abundant. If we are to see our economy really grow, we need to encourage migratory capital to become productive capital - capital invested for the long-term in empowering innovations.

I'd love if people relearned the lessons of the 20th century all over again. Which is to say this country progressed economically and socially when we had a better balance between capital and labor. Neither capital or labor won every argument. The battle between the two created economic tension, and transformed the working class into the middle class, and grew the economy.