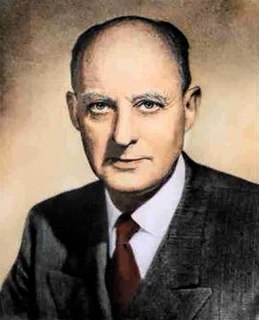

A Quote by William Greider

The brilliant creative core of capitalism ... is the story the entrepreneurs and capital investors tell themselves about the future. How they intend to alter it, what they expect to gain in return, where they will raise the capital to accomplish their vision. Many of their stories turn out to be flawed or mistaken, of course, but the capacity to envision a set of future events and then act to fulfill them is a central source of capitalism's strength and its dominance of society.

Quote Topics

About

Accomplish

Act

Alter

Brilliant

Capacity

Capital

Capitalism

Central

Core

Course

Creative

Dominance

Entrepreneurs

Envision

Events

Expect

Flawed

Fulfill

Future

Future Events

Gain

How

Intend

Investors

Many

Mistaken

Out

Raise

Return

Set

Society

Source

Stories

Story

Strength

Tell

Them

Themselves

Then

Turn

Vision

Will

Related Quotes

If the investors themselves are not sophisticated, if they themselves are not putting a lot of their own money to work, if they themselves don't understand the continuum of capital and how different parts of the capital structures react differently, then they're basically worthless. They're not going to give great advice to these entrepreneurs who then need it. So that is unfortunately the cycle we're in and we have to break the cycle.

The idea that the profits of capital are really the rewards of a just society for the foresight and thrift of those who sacrificed the immediate pleasures of spending in order that society might have productive capital, had a certain validity in the early days of capitalism, when productive enterprise was frequently initiated through capital saved out of modest incomes.

Obviously, consideration of costs is key, including opportunity costs. Of course capital isn't free. It's easy to figure out your cost of borrowing, but theorists went bonkers on the cost of equity capital. They say that if you're generating a 100% return on capital, then you shouldn't invest in something that generates an 80% return on capital. It's crazy.

I don't like the idea of capitalism anyway. Because it's not capital we are talking about; it's knowledge and creating well-being. Because I mean, that gets people on the wrong track when it's capital and how we allocate capital - no. How do we create the Republic of Science in America? How do we have a system of mutual benefits where people succeed by helping others improve their lives? So I don't like that at all.

I know the difference between venture capital[ism] and vulture capitalism. Venture capitalism is a good thing, comes in, gives that gap funding to help these companies get off and get started creating jobs, and work. But Mitt Romney and Bain Capital were involved with what I call vulture capitalism. And they walked into Gaffney and took over that photo album company for no other reason than to basically pick the bones clean. And those people lost their jobs.

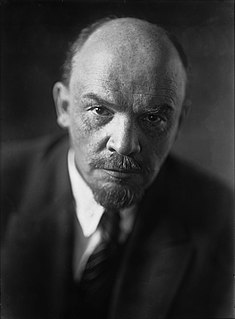

Imperialism is capitalism at that stage of development at which the dominance of monopolies and finance capitalism is established; in which the export of capital has acquired pronounced importance; in which the division of the world among the international trusts has begun, in which the division of all territories of the globe among the biggest capitalist powers has been completed.