A Quote by William Howard Taft

One of the reforms to be carried out during the incoming administration is a change in our monetary and banking laws, so as to secure greater elasticity in the forms of currency available for trade and to prevent the limitations of law from operating to increase the embarrassment of a financial panic.

Related Quotes

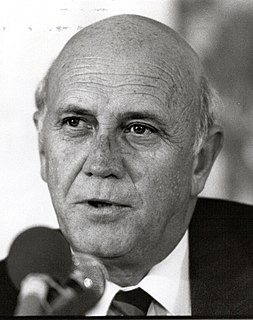

From the time I entered cabinet, the emphasis was on reforms, but reforms which did not abolish separate development, but reforms which were aimed at changing the very, very dehumanising aspects. Giving greater freedom of movement, giving private property ownership within so-called white South Africa also to blacks. Abolishing the concept of job reservation on the basis of race and colour. Allowing free organisation for trade unions, also black trade unions.

National law has no place in cyberlaw. Where is cyberspace? If you don't like banking laws in the United States, set up your machine on the Grand Cayman Islands. Don't like the copyright laws in the United States? Set up your machine in China. Cyberlaw is global law, which is not going to be easy to handle, since we seemingly cannot even agree on world trade of automobile parts.

The regulator banned cryptocurrency... then there was an order from the Supreme Court. So, in the absence of any strong law, it was very important for us to come out with a comprehensive law-one for the private digital currency and second for the government for its digital form of currency, or the virtual currency.

Anyone interested in the past, present, or future of banking and financial crises should read The Bankers' New Clothes. Admati and Hellwig provide a forceful and accessible analysis of the recent financial crisis and offer proposals to prevent future financial failures. While controversial, these proposals--whether you agree or disagree with them--will force you to think through the problems and solutions.

Innovation has stalled in the banking industry. While the rest of the world is in the digital age, banking remains stagnant. We are here to change this and bring banking to the 21st century. We will ensure our customers feel involved in the progress of this bank and are offering them a truly enjoyable banking experience – different from anything they have experienced before.

The [Barack Obama] administration is sharing its knowledge, its expertise with the incoming administration. And this, to us, is a sign of encouragement, to continue the good cooperation that we have built between the United States of America and the Federal Republic of Germany that is in our mutual interest.