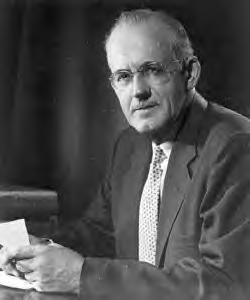

A Quote by William J. H. Boetcker

The more men, generally speaking, will do for a Dollar when they make it, the more that Dollar will do for them when they spend it.

Related Quotes

The value of a dollar is to buy just things; a dollar goes on increasing in value with all the genius and all the virtue of the world. A dollar in a university is worth more than a dollar in a jail; in a temperate, schooled, law-abiding community than in some sink of crime, where dice, knives, and arsenic are in constant play.

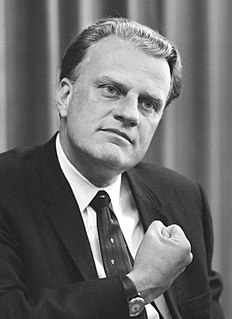

I favor the policy of economy, not because I wish to save money, but because I wish to save people. The men and women of this country who toil are the ones who bear the cost of the Government. Every dollar that we carelessly waste means that their life will be so much the more meager. Every dollar that we save means that their life will be so much the more abundant. Economy is idealism in its most practical form.

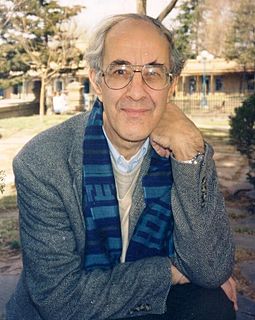

Gold has intrinsic value. The problem with the dollar is it has no intrinsic value. And if the Federal Reserve is going to spend trillions of them to buy up all these bad mortgages and all other kinds of bad debt, the dollar is going to lose all of its value. Gold will store its value, and you'll always be able to buy more food with your gold.

'As a fraction of your tax dollar today, what is the total cost of all spaceborne telescopes, planetary probes, the rovers on Mars, the International Space Station, the space shuttle, telescopes yet to orbit, and missions yet to fly?' Answer: one-half of one percent of each tax dollar. Half a penny. I'd prefer it were more: perhaps two cents on the dollar. Even during the storied Apollo era, peak NASA spending amounted to little more than four cents on the tax dollar.