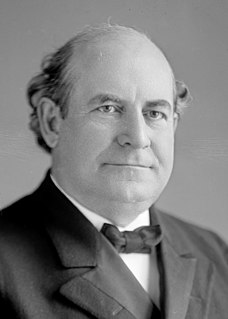

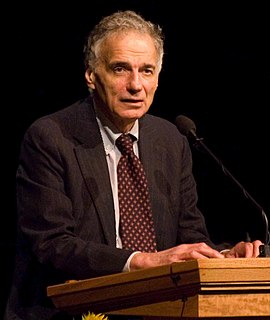

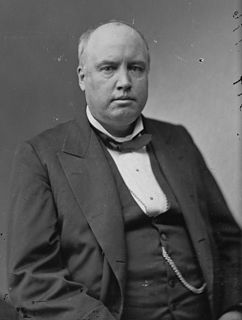

A Quote by William Jennings Bryan

Real estate is the best investment for small savings. More money is made from the rise in real estate values than from all other causes combined.

Quote Topics

Related Quotes

The business side of real estate investing is fraught with risk. Unlike purchasing mutual funds or savings bonds, with real estate, you can lose money; this is one of the reasons that seasoned real estate investors caution neophytes never to get too emotional about a property and always be willing to walk away.

What went wrong is we had tremendous concentration in the sense we put a lot of our money to work against U.S. real estate. We got here by lending money, and putting money to work in the U.S. real estate market, in a size that was probably larger than what we ought to have done on a diversification basis.

Today the strategies of many companies in the real estate industry are premised on low interest rates, an assumption that has resulted in the rapid expansion of the real estate securitization business. This trend could be regarded as a risk factor, as it exposes the real estate sector to at least three potential problems: first, interest rate hikes; second, revisions to securitization business accounting standards; and third, overheating in the real estate market.