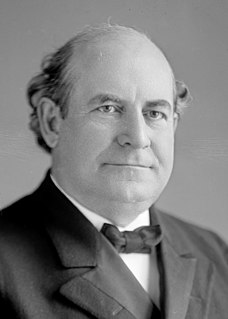

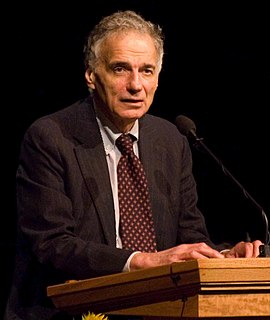

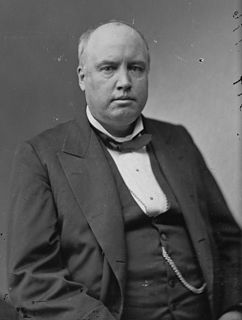

A Quote by William Jennings Bryan

That is the one thing in my public career that I regret--my work to secure the enactment of the Federal Reserve Law.

Related Quotes

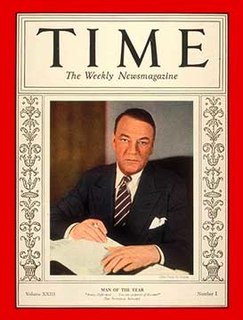

Transparency concerning the Federal Reserve's conduct of monetary policy is desirable because better public understanding enhances the effectiveness of policy. More important, however, is that transparent communications reflect the Federal Reserve's commitment to accountability within our democratic system of government.

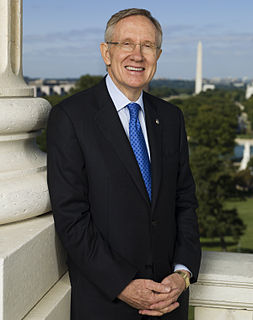

If the Federal Reserve pursues a policy which Congress or the President believes not to be in the public interest, there is nothing Congress can do to reverse the policy. Nor is there anything the people can do. Such bastions of unaccountable power are undemocratic. The Federal Reserve System must be reformed, so that it is answerable to the elected representatives of the people.

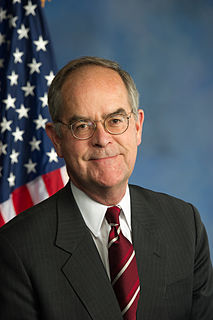

I attended law school, the progression into a career in corporate law was almost foreordained. I set about to craft a career reflective of my values. These included: public service, environmental protection, and leadership development. Trusting my instincts, following my heart, enabled me to create a calling that became a career.