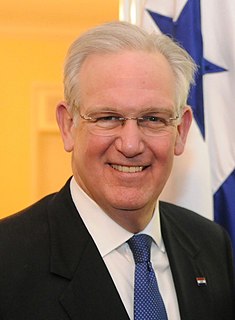

A Quote by William Kristol

Tax credits instead of a huge bureaucracy. This is the question for me.

Related Quotes

The tax that was supposed to soak the rich has instead soaked America. The beneficiary of the income tax has not been the poor, but big government. The income tax has given us a government bureaucracy that outnumbers the manufacturing work force. It has created welfare dependencies that have entrapped millions of Americans in an underclass that is forced to live a sordid existence of trading votes for government handouts.

Labour ministers often look puzzled when reports show that Britain has one of the lowest levels of social mobility in the developed world. They just don't get it. They see poverty, inequality, fairness, as all about income. For the past 12 years, they have relied on tax credits to solve this. But tax credits do not solve poverty: they mask it.