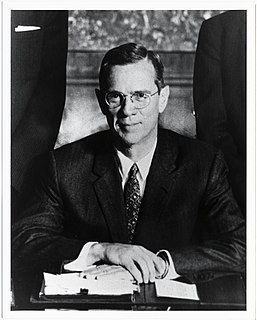

A Quote by William McChesney Martin

The Federal Reserve... is in the position of the chaperone who has ordered the punch bowl removed just when the party was really warming up.

Related Quotes

Before I studied the art, a punch to me was just like a punch, a kick just like a kick. After I learned the art, a punch was no longer a punch, a kick no longer a kick. Now that I've understood the art, a punch is just like a punch, a kick just like a kick. The height of cultivation is really nothing special. It is merely simplicity; the ability to express the utmost with the minimum.

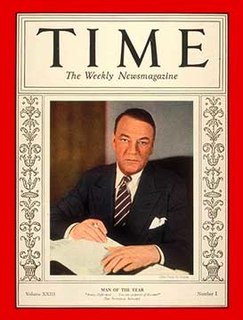

Transparency concerning the Federal Reserve's conduct of monetary policy is desirable because better public understanding enhances the effectiveness of policy. More important, however, is that transparent communications reflect the Federal Reserve's commitment to accountability within our democratic system of government.

America really started to die when the Federal Reserve was founded, and it really started to die in 1971 when the gold backing was taken away from the dollar, and this currency with Ben Bernanke just printing up or counterfeiting as much money as he wants and destroying the economy is really destroying the economy.

When it comes to the Federal Reserve, there's an awful lot of books out there; in my library, I bet I've got 200 books if I've got any on the Federal Reserve. And we don't need any more books, we need action, and that's what the Liberty Dollar did, it gave people a way to take action. Our catch phrase was you want to "make money, do good, and have fun," and people really responded to that.