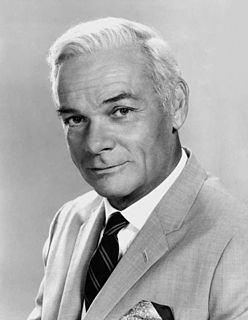

A Quote by William O'Neil

The market has a simple way of whittling all excessive pride and overblown egos down to size. After all, the whole idea is to be completely objective and recognize what the marketplace is telling you, rather than try to prove that the thing you said or did yesterday or six weeks ago was right. The fastest way to take a bath in the stock market or go broke is to try to prove that you are right and the market is wrong.

Related Quotes

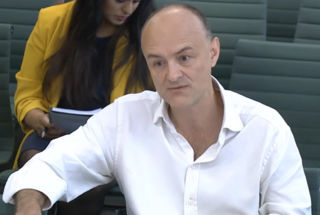

The hardest thing over the years has been having the courage to go against the dominant wisdom of the time to have a view that is at variance with the present consensus and bet that view. The hard part is that the investor must measure himself not by his own perceptions of his performance, but by the objective measure of the market. The market has its own reality. In an immediate emotional sense the market is always right so if you take a variant point of view you will always be bombarded for some time by conventional wisdom as expressed by the market.

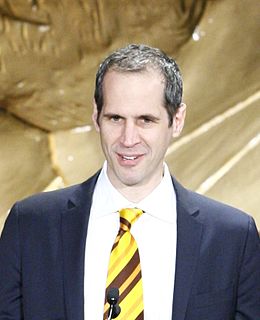

I believe in market economics. But to paraphrase Churchill - who said this about democracy and political regimes - a market economy might be the worst economic regime available, apart from the alternatives. I believe that people react to incentives, that incentives matter, and that prices reflect the way things should be allocated. But I also believe that market economies sometimes have market failures, and when these occur, there's a role for prudential - not excessive - regulation of the financial system.

An old market had stood there until I'd been about six years old, when the authorities had renamed it the Olde Market, destroyed it, and built a new market devoted to selling T-shirts and other objects with pictures of the old market. Meanwhile, the people who had operated the little stalls in the old market had gone elsewhere and set up a thing on the edge of town that was now called the New Market even though it was actually the old market.

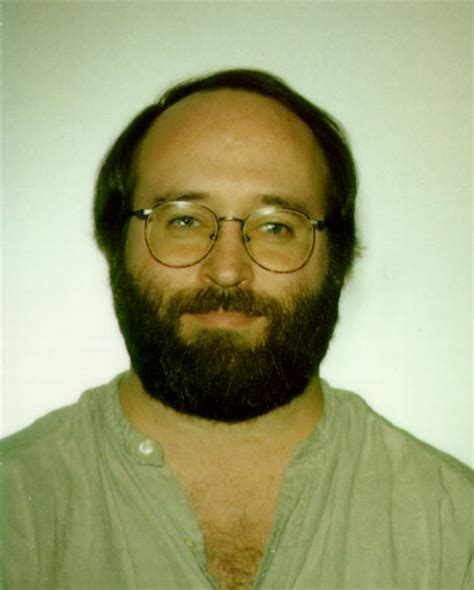

My father always said 'There's no free lunch.' My father was right. There's no free lunch and there's no free market. The market is rigged, the market is always rigged, and the rigging is in favour of the people who run the market. That's what the market is. It's a bent casino. The house always wins.

My father was a person who always allowed me to do what I wanted but he told me you want to go to a stock market, first get yourself qualified. So, I qualified myself as a chartered accountant and my dad said what do you want to do? I said I want to go to the stock market. He asked what will you do? I said I invest.

Successful investors like stocks better when they’re going down. When you go to a department store or a supermarket, you like to buy merchandise on sale, but it doesn’t work that way in the stock market. In the stock market, people panic when stocks are going down, so they like them less when they should like them more. When prices go down, you shouldn’t panic, but it’s hard to control your emotions when you’re overextended, when you see your net worth drop in half and you worry that you won’t have enough money to pay for your kids’ college.