A Quote by William O'Neil

The whole secret to winning and losing in the stock market is to lose the least amount possible when you're not right.

Related Quotes

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

In America, snobs who wouldn't be seen dead with a lottery ticket play the stock market. We like to gamble. Winning, we have closed our eyes, leapt across the yawning abyss, and landed knee-deep in daisies. Even losing has a certain gloomy glamour: the gods of chance are worthy opponents; we have engaged them in hand-to-hand combat and though we lost, at least we shrank not from the contest.

The market has a simple way of whittling all excessive pride and overblown egos down to size. After all, the whole idea is to be completely objective and recognize what the marketplace is telling you, rather than try to prove that the thing you said or did yesterday or six weeks ago was right. The fastest way to take a bath in the stock market or go broke is to try to prove that you are right and the market is wrong.

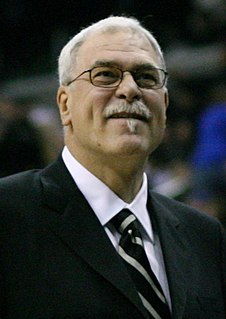

And yet as a coach, I know that being fixated on winning (or more likely, not losing) is counterproductive, especially when it causes you to lose control of your emotions. What’s more, obsessing about winning is a loser’s game: The most we can hope for is to create the best possible conditions for success, then let go of the outcome. The ride is a lot more fun that way.

And at a relatively early age, ten or so, I invested my first share of stock. And I used to follow, look at companies and so forth. But throughout the whole period, and indeed right through my college years, while I was involved in the stock market, always interested in finance, I never thought of it as a full-time job.

You can't just say, 'This team's going to win,' or 'This team's going to lose.' Anything can happen. So what you can control is winning your game as much as possible. If you don't do that, and then the other team has a chance to lose, and they lose, and you didn't go about it the right way, now you just let that slip.