A Quote by William Vickrey

Economists are almost unanimous in conceding that the land tax has no adverse side effects. ...Landowners ought to look at both sides of the coin. Applying a tax to land values also means removing other taxes. This would so improve the efficiency of a city that land values would go up more than the increase in taxes on land.

Related Quotes

Land taxes is the thing. They got so high that there is no chance to make anything. Not only land but all property tax. You see in the old days, why the only thing they knew how to tax was land, or a house. Well, that condition went along for quite awhile, so even today the whole country tries to run its revenue on taxes on land. They never ask if the land makes anything. "It's land ain't it? Well tax it then."

Assuming that a tax increase is necessary, it is clearly preferable to impose the additional cost on land by increasing the land tax, rather than to increase the wage tax - the two alternatives open to the City (of Pittsburgh). It is the use and occupancy of property that creates the need for the municipal services that appear as the largest item in the budget - fire and police protection, waste removal, and public works. The average increase in tax bills of city residents will be about twice as great with wage tax increase than with a land tax increase.

Our ideal society finds it essential to put a rent on land as a way of maximizing the total consumption available to the society. ...Pure land rent is in the nature of a 'surplus' which can be taxed heavily without distorting production incentives or efficiency. A land value tax can be called 'the useful tax on measured land surplus'.

It is easier to start taxes than to stop them. A tax an inch long can easily become a yard long. That has been the history of the income tax. Would not the sales tax be likely to have a similar history [in the U.S.]? ... Canadian newspapers report that an increase in the sales tax threatens to drive the Mackenzie King administration out of office. Canada began with a sales tax of 2%.... Starting this month the tax is 6%. The burden, in other words, has already been increased 200% ... What the U.S. needs is not new taxes, is not more taxes, but fewer and lower taxes.

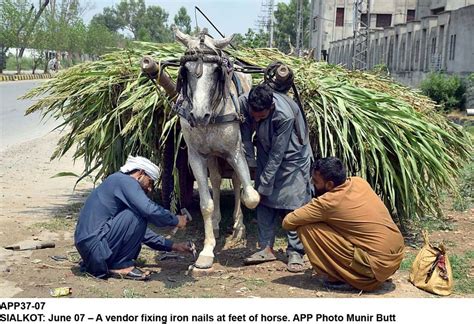

We have landowners, small growers. We have people who are holding onto land that was acquired by their families after slavery. They need to produce some of the food we eat, so they can pay the taxes and hold onto the property. Taxes keep going up. We, and by we I mean black people, are rapidly becoming a landless people. Our ancestors, coming out of slavery, acquired more than 15 million acres of land. Today, we're probably down to less than 2 million acres.

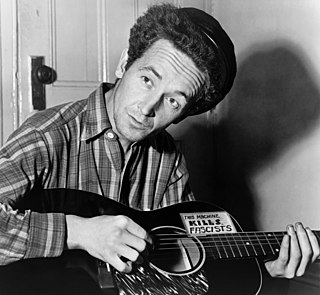

As I went walking I saw a sign there And on the sign it said "No Trespassing." But on the other side it didn't say nothing, That side was made for you and me. This land is your land, this land is my land From California to the New York island From the Redwood forest to the Gulf Stream waters This land was made for you and me.

First thing the developer has to do is to get an assessment of the threatened species, of the ecological values of that site. At the moment, that developer lodges an application, there's usually trade-offs, negotiations, you end up with remnant bits of land. You might end up with some other offset land that the public has to run. There's no cohesive system of then making sure that we maintain and improve biodiversity values.

A Land Valuation Tax is a levy on the value of the land unimproved by buildings or other enhancement. The method is already used by insurance companies each year when they calculate your home insurance premium - they separate the cost of a total rebuild of the property from the value of the land itself.

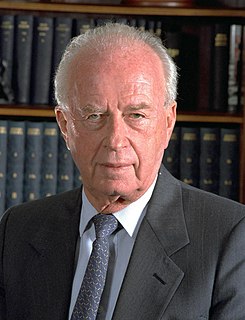

Here, in the Land of Israel, we returned and built a nation. Here, in the Land of Israel, we established a State. The Land of the prophets, which bequeathed to the world the values of morality, law and justice, was after two thousand years, restored to its lawful owner - the members of the Jewish People, On its Land, we have built an exceptional national Home and State.

Taxes are paid in the sweat of every man who labors. If those taxes are excessive, they are reflected in idle factories, in tax-sold farms, and in hordes of hungry people, tramping the streets and seeking jobs in vain. Our workers may never see a tax bill, but they pay. They pay in deductions from wages, in increased cost of what they buy, or - as now - in broad unemployment throughout the land.