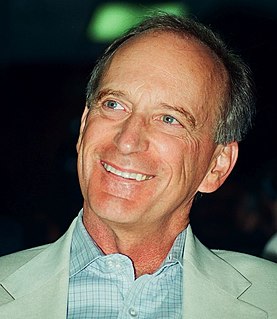

A Quote by Willie Geist

I have a simple plan to solve the economic crisis. Give every American a $100 credit to the dog track of their choice. I have found the puppies to be a reliable source of income with a consistent rate of return.

Related Quotes

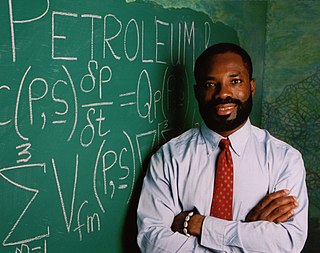

If top marginal income tax rates are set too high, they discourage productive economic activity. In the limit, a top marginal income tax rate of 100 percent would mean that taxpayers would gain nothing from working harder or investing more. In contrast, a higher top marginal rate on consumption would actually encourage savings and investment. A top marginal consumption tax rate of 100 percent would simply mean that if a wealthy family spent an extra dollar, it would also owe an additional dollar of tax.

he economy favors throughput over quality and craftsmanship, and economists are terrified because the American savings rate has crept upward from about zero to almost five percent. But the mortgage crisis and the burgeoning credit card crisis are causing Americans to become wary of irresponsible debt.

Let's take the nine states that have no income tax and compare them with the nine states with the highest income tax rates in the nation. If you look at the economic metrics over the last decade for both groups, the zero-income-tax-rate states outperform the highest-income-tax-rate states by a fairly sizable amount.

It makes no difference to a widow with her savings in a 5 percent passbook account whether she pays 100 percent income tax on her interest income during a period of zero inflation or pays no income tax during years of 5 percent inflation. Either way, she is 'taxed' in a manner that leaves her no real income whatsoever. Any money she spends comes right out of capital. She would find outrageous a 100 percent income tax but doesn't seem to notice that 5 percent inflation is the economic equivalent.

If you look at the performance of the zero-income-tax-rate states and the highest-income-tax-rate states, I believe a large amount of their difference is due to taxes. Not only is it true of the last decade, but I took these numbers back 50 years. And, there's not one year in the last 50 where the zero-income-tax-rate states have not outperformed the highest-income-tax-rate states.

One of the issues with some of these lenders is going to be, where will their provider of credit be when there's a crisis? That's why some of these smarter services, to support their operations, are courting more permanent capital. They want a source of longer-term funding that can survive a crisis.

Debt, we've learned, is the match that lights the fire of every crisis. Every crisis has its own set of villains - pick your favorite: bankers, regulators, central bankers, politicians, overzealous consumers, credit rating agencies - but all require one similar ingredient to create a true crisis: too much leverage.