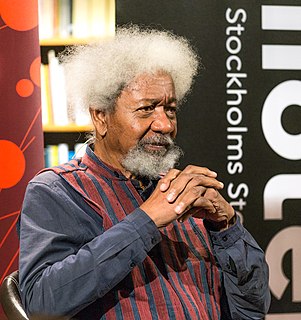

A Quote by Wole Soyinka

In Africa, those who have money - businessmen and banks - do not believe in film.

Related Quotes

In our election manifesto is: we keep the right to create money and to bring in circulation, for the cause of the government ... Those who do not share this view, reply us to the issue of paper money is for the banks, the government should stay out of the banking business. I agree with Jefferson's opinion ... and just like him I say again: the issue of money is a matter for the government and the banks should stay out of government activity.

In a world of businessmen and financial intermediaries who aggressively seek profit, innovators will always outpace regulators; the authorities cannot prevent changes in the structure of portfolios from occurring. What they can do is keep the asset-equity ratio of banks within bounds by setting equity-absorption ratios for various types of assets. If the authorities constrain banks and are aware of the activities of fringe banks and other financial institutions, they are in a better position to attenuate the disruptive expansionary tendencies of our economy.

African films should be thought of as offering as many different points of view as the film of any other different continent. Nobody would say that French film is all European film, or Italian film is all European film. And in the same way that those places have different filmmakers that speak to different issues, all the countries in Africa have that too.

We [US government] have used our taxpayer dollars not only to subsidize these banks but also to subsidize the creditors of those banks and the equity holders in those banks. We could have talked about forcing those investors to take some serious hits on their risky dealings. The idea that taxpayer dollars go in first rather than last - after the equity has been used up - is shocking.

Sadly most films only get exposure if they win an award or were in a festival, which is really difficult because those things cost money! Submitting your film to a festival or campaigning for an Oscar or a Golden Globe is very expensive. Most people don't know that, but all those events require a lot of money. If you have a small independent film, it's very hard to get the attention of people in those circles.

I passionately disagreed with Treasury Secretary Hank Paulson's plan to bail out the banks by using a public fund called the Troubled Asset Relief Program (TARP) to help banks take toxic assets off their balance sheets. I argued that it would be much better to put the money where the hole was and replenish the equity of the banks themselves.