A Quote by Wolfgang Schauble

The German export successes are not the result of some sort of currency manipulation, but of the increased competitiveness of companies. The American growth model, on the other hand, is in a deep crisis.

Related Quotes

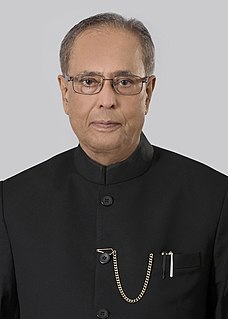

We must recognise that in a globalised world, we cannot remain insulated from external developments. India's trade performance in the current year has been robust, surpassing pre-crisis export levels and pre-crisis export growth trends. We have diversified our export baskets and our export destinations.

A strong currency means that American consumers and businesses can buy imported goods and services more cheaply and that inflation and interest rates will be lower, ... It also puts pressure on American industry to increase productivity and competitiveness. These benefits can feed on themselves as foreign capital flows in more readily because of greater confidence in our currency. A weak dollar would have the contrary effects.

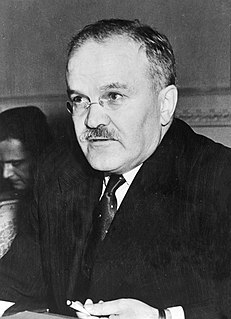

Our scientists all the more occupy advanced positions in the development of world science. By the example of their successes in the field of atomic energy, our scientists and technicians have vividly shown how much the increased might of the Soviet state and the further growth of its international authority depends on their efforts and practical successes.