A Quote by Wolfgang Schauble

I would caution against fueling cheap populism. First of all, every German who has spent a vacation in Greece knows that the standard of living there isn't higher than it is in Germany. Second, Greece is paying a high price for European assistance.

Related Quotes

Greeks have to know that they are not alone ... Those who are fighting for the survivor of Greece inside the Euro area are deeply harmed by the impression floating around in the Greek public opinion that Greece is a victim. Greece is a member of the EU and the euro. I want Greece to be a constructive member of the Union because the EU is also benefiting from Greece.

Businesses will only invest in Greece if three conditions are fulfilled. First, there must be a clear commitment to the euro. No businesses will invest if they have to fear that Greece will leave the euro zone at some point. Second, the Greek government must be prepared to work together with European institutions in order to restructure the country.

Look at Ukraine. Its currency, the hernia, is plunging. The euro is really in a problem. Greece is problematic as to whether it can pay the IMF, which is threatening not to be part of the troika with the European Central Bank and the European Union making more loans to enable Greece to pay the bondholders and the banks. Britain is having a referendum as to whether to withdraw from the European Union, and it looks more and more like it may do so. So the world's politics are in turmoil.

Greece's European neighbors were able step in and bolster the weak foundation on which Greece's free-spending budget was based. It would be difficult for any country, or intergovernmental organization, to rescue an economy the size of the U.S. if investors were ever to lose faith in our bonds because of our enormous debt.

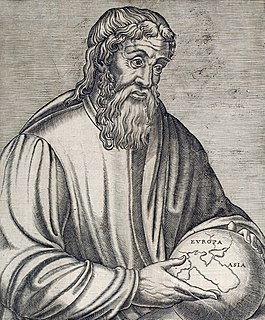

There remain of Europe, first, Macedonia and the part of Thrace that are contiguous to it and extend as far as Byzantium; secondly, Greece; and thirdly, the Islands that are close by. Macedonia, of course, is a part of Greece, yet now, since I am following the nature and shape of the place geographically, I have decided to classify it apart from the rest of Greece and to join it with that part of Thrace.

We should recall that during the Second World War and the Great Depression there was an upsurge in popular, radical democracy. In all over the world. It took different forms, but it was there, everywhere. In Greece it was in the Greek revolution, and so on. And it had to be crushed. In countries like Greece, it was crushed by violence. In countries like Italy, where the US forces entered in 1943, it was crushed by attacking and destroying the anti-German partisans and restoring the traditional order.

Following Greece's defeat at the hands of Turkey in 1897, Greece's fiscal house was entrusted to a Control Commission. During the 20th century, the drachma was one of the world's worst currencies. It recorded the world's sixth highest hyperinflation. In October 1944, Greece's monthly inflation rate hit 13,800%.