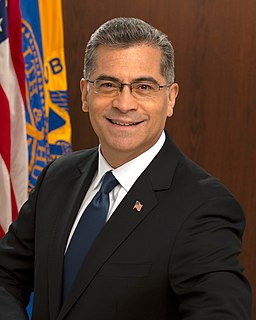

A Quote by Xavier Becerra

We have a tax code that allows groups to use their political operations within the tax code, under the guise of a charity, to use undisclosed millions of dollars to do political campaigns.

Related Quotes

We need to lower tax rates for everybody, starting with the top corporate tax rate. We need to simplify the tax code. The ultimate answer, in my opinion, is the fair tax, which is a fair tax for everybody, because as long as we still have this messed-up tax code, the politicians are going to use it to reward winners and losers.

You can use the tax code to make people smoke less. You can use the tax code to make 'em smoke more. You can use the tax code to make 'em buy beer or buy less beer, more booze or less booze. You can screw the tax code around to make 'em make more charitable contributions. You think they're going to get rid of this power? Ain't no way, fool.

The 9-9-9 plan would resuscitate this economy because it replaces the outdated tax code that allows politicians to pick winners and losers, and to provide favors in the form of tax breaks, special exemptions and loopholes. It simplifies the code dramatically: 9% business flat tax, 9% personal flat tax, 9% sales tax.

We need to enact fundamental tax reform. The weight and complexity of our 73,000-page tax code are crushing everyday Americans. We need to radically simplify the tax code so that we can re-start the real engine of growth in our economy. That means our tax code needs to go from 73,000 pages down to about three pages.

We've got a tax code that is encouraging flight of jobs and outsourcing. And that's why we've specifically recommended in this campaign that Congress change our tax code so that we stop giving tax breaks to companies that are moving to Mexico and China and other places, and start putting those tax breaks into companies that are investing here in the United States.

I think that taxes would be fair if we first get rid of the tax code. This is the ultimate solution, not to just say we're going to trim around the edges, not to say that we will try to simplify a little of this and a little of that. The problem is, replace the tax code, so we can establish tax fairness for everybody.

Because of tax laws governing charities, including almost every single civil rights organization you've ever heard of, including the NAACP, the Urban League, the ACLU, and others, those organizations are not allowed to endorse political candidates or use their resources in political campaigns of any kind.