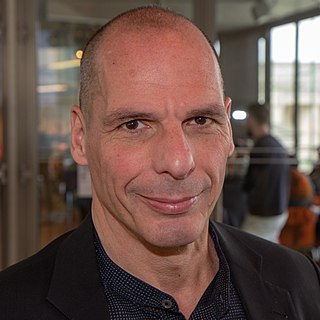

A Quote by Yanis Varoufakis

Every sensible banker understands that Greece should not have received any more money: a bankrupt state that can never be expected to repay loans is not a good debtor.

Related Quotes

Reality is a state of mind. To the banker, the money in his ledger book is all very real, though he doesn't actually see it or touch it. But to the Brahma, it simply doesn't exist the way the air and the earth, pain and loss do. To him, the banker's reality is folly. To the banker, the Brahma's ideas are as inconsequential as dust.

I would injure no man, and should provoke no resentment. I would relieve every distress, and should enjoy the benedictions of gratitude. I would choose my friends among the wise and my wife among the virtuous, and therefore should be in no danger from treachery or unkindness. My children should by my care be learned and pious, and would repay to my age what their childhood had received.

Let us never forget this fundamental truth: the State has no source of money other than money which people earn themselves. If the State wishes to spend more it can do so only by borrowing your savings or by taxing you more. It is no good thinking that someone else will pay - that 'someone else' is you. There is no such thing as public money; there is only taxpayers' money.

If the Lord should give you power to raise the dead, He would give much less than He does when he bestows suffering. By miracles you would make yourself debtor to Him, while by suffering He may become debtor to you. And even if sufferings had no other reward than being able to bear something for that God who loves you, is not this a great reward and a sufficient remuneration? Whoever loves, understands what I say.

Look at Ukraine. Its currency, the hernia, is plunging. The euro is really in a problem. Greece is problematic as to whether it can pay the IMF, which is threatening not to be part of the troika with the European Central Bank and the European Union making more loans to enable Greece to pay the bondholders and the banks. Britain is having a referendum as to whether to withdraw from the European Union, and it looks more and more like it may do so. So the world's politics are in turmoil.

The art of banking is always to balance the risk of a run with the reward of a profit. The tantalizing factor in the equation is that riskier borrowers pay higher interest rates. Ultimate safety - a strongbox full of currency - would avail the banker nothing. Maximum risk - a portfolio of loans to prospective bankrupts at usurious interest rates - would invite disaster. A good banker safely and profitably treads the middle ground.