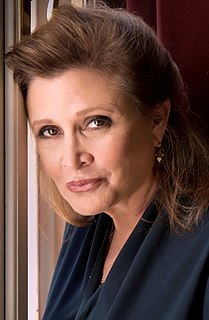

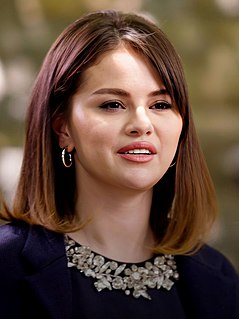

A Quote by Yasmine Bleeth

This is my ultimate fantasy: watching QVC with a credit card while making love and eating at the same time.

Related Quotes

In about one-third of credit card consolidations, within a short period of time, the cards come back out of the wallet, and in no time at all, they're charged back up. Then you're in an even worse position, because you have the credit card debt and the consolidation loan to worry about. You're in a hole that's twice as deep - and twice as steep.

If you have credit card debt and credit card companies continue to close down the cards, what are you going to do? What are you going to do if they raise your interest rates to 32 percent? That's five times higher than what your kid is going to pay in interest on a student loan. Get rid of your credit card debt.

I have no credit cards. That was the decision that was made jointly by the credit card companies, and by me. I can't say that that was completely on my account. I buy nothing on credit now, nothing. If I can't afford it, I don't buy it. I have a debit card, that's all I have. Any debt that I have, I am paying down.

It's a tale of redemption. It's a tale of a girl who is going on a journey, who makes mistakes as most young people do... the credit card companies love sending you credit cards so you exceed your limit and they can charge you interest. And this is a girl who overcomes her problems and figures a way out of her financial crisis, and hopefully the world will do the same thing.