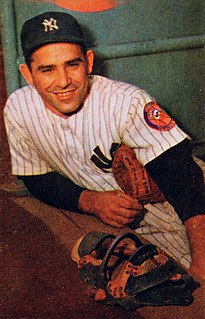

A Quote by Yogi Berra

Buy a stock, if it goes up, sell it, if it goes down, don't buy it.

Related Quotes

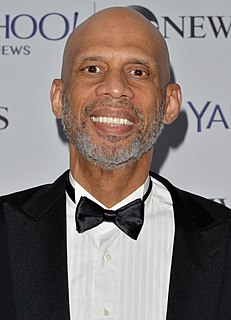

Here’s how to know if you have the makeup to be an investor. How would you handle the following situation? Let’s say you own a Procter & Gamble in your portfolio and the stock price goes down by half. Do you like it better? If it falls in half, do you reinvest dividends? Do you take cash out of savings to buy more? If you have the confidence to do that, then you’re an investor. If you don’t, you’re not an investor, you’re a speculator, and you shouldn’t be in the stock market in the first place.

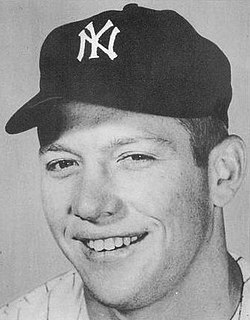

Don't try to buy art as an investment. Buy something you really love because you're going to have to look at it again tomorrow. And an investment can go up or down. Buy something you really adore, you really like, and you want to live with. And if you decide some years later you don't want to live with it anymore, sell it. Get out.