A Quote by Yuriy Tarnawsky

Except for the usual house chores, doing income tax, etc., I am free to write whenever I want.

Related Quotes

Being in unfamiliar places has no effect on my writing, except that it often means I'm caught up in the logistics of travel, the places and people on the spot, etc., etc., which can mean that I don't have the time to write. But I try, wherever I am, to take a couple of hours in the early evening to go off and write. Because I never write from personal experience, per se, where I am makes no difference except for this element of available time.

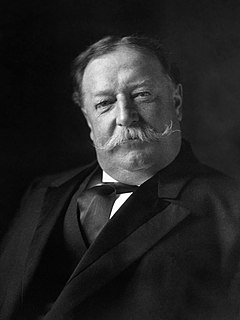

I prefer an income tax, but the truth is I am afraid of the discussion which will follow and the criticism which will ensue if there is an other division in the Supreme Court on the subject of the income tax. Nothing has injured the prestige of the Supreme Court more than that last decision, and I think that many of the most violent advocates of the income tax will be glad of the substitution in their hearts for the same reasons. I am going to push the Constitutional amendment, which will admit an income tax without questions, but I am afraid of it without such an amendment.

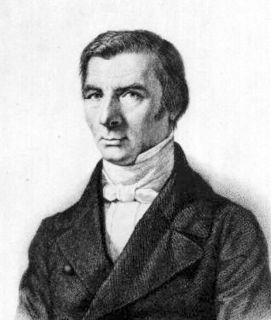

Legal plunder can be committed in an infinite number of ways; hence, there are an infinite number of plans for organizing it: tariffs, protection, bonuses, subsidies, incentives, the progressive income tax, free education, the right to employment, the right to profit, the right to wages, the right to relief, the right to the tools of production, interest free credit, etc., etc. And it the aggregate of all these plans, in respect to what they have in common, legal plunder, that goes under the name of socialism.

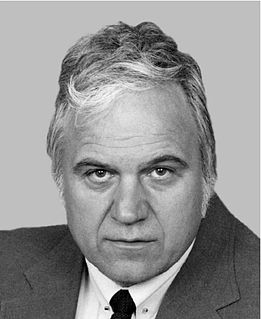

Let's take the nine states that have no income tax and compare them with the nine states with the highest income tax rates in the nation. If you look at the economic metrics over the last decade for both groups, the zero-income-tax-rate states outperform the highest-income-tax-rate states by a fairly sizable amount.

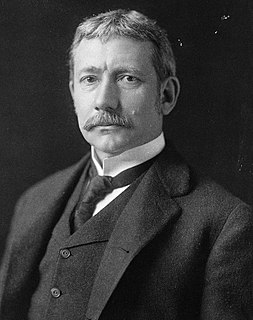

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

I have been privileged to write across multiple facets of my life: to write romance novels, to write memoir, to write about leadership, and to write tax and social policy articles. The act of writing is integral to who I am. I'm a writer, a politician, a tax attorney, a civic leader, and an entrepreneur. I am proud of what I've accomplished.

In 1848, Karl Marx said, a progressive income tax is needed to transfer wealth and power to the state. Thus, Marx's Communist Manifesto had as its major economic tenet a progressive income tax. ... I say it is time to replace the progressive income tax with a national retail sales tax, and it is time to abolish the IRS.

All taxes, except a 'lump-sum tax,' introduce distortions in the economy. But no government can impose a lump-sum tax - the same amount for everyone regardless of their income or expenditures - because it would fall heaviest on those with less income, and it would grind the poor, who might be unable to pay it at all.

I guess you will have to go to jail. If that is the result of not understanding the Income Tax Law, I will meet you there. We shall have a merry, merry time, for all our friends will be there. It will be an intellectual center, for no one understands the Income Tax Law except persons who have not sufficient intelligence to understand the questions that arise under it.

If you look at the performance of the zero-income-tax-rate states and the highest-income-tax-rate states, I believe a large amount of their difference is due to taxes. Not only is it true of the last decade, but I took these numbers back 50 years. And, there's not one year in the last 50 where the zero-income-tax-rate states have not outperformed the highest-income-tax-rate states.

There is the general belief that the corporation income tax is a tax on the "rich" and on the "fat cats." But with pension funds owning 30% of American large business-and soon to own 50%-the corporation income tax, in effect, eases the load on those in top income brackets and penalizes the beneficiaries of pension funds.

When two working people decide to marry, their federal income tax is usually increased. As soon as one spouse earns at least 20 percent of a married couple's total income, the couple pays a 'marriage tax.' ... The United States is the only major industrialized nation in the free world in which the tax cost of the second [married] earner's entry into the work force is higher than that of the first. On one hand, our government's social policy is to help working women earn equal salaries to those of men, but on the other we have a tax structure that penalizes them when they do so.