A Quote by Adam Smith

To subject every private family to the odious visits and examination of the tax-gatherers ... would be altogether inconsistent with liberty.

Quote Topics

Related Quotes

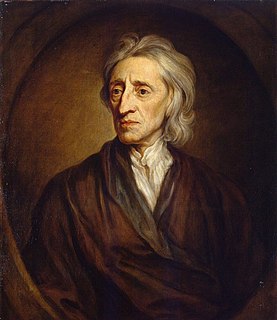

If to break loose from the bounds of reason, and to want that restraint of examination and judgment which keeps us from choosing or doing the worst, be liberty, true liberty, madmen and fools are the only freemen: but yet, I think, nobody would choose to be mad for the sake of such liberty, but he that is mad already.

The habit of seen the public rule, is gradually accustoming the American mind to an interference with private rights that is slowly undermining the individuality of the national character. There is getting to be so much public right, that private right is overshadowed and lost. A danger exists that the ends of liberty will be forgotten altogether in the means.

If one individual, or one class, can call in the aid of authority to ward off the effects of competition, it acquires a privilege and at the cost of the whole community; it can make sure of profits not altogether due to the productive services rendered, but composed in part of an actual tax upon consumers for its private profit' which tax it commonly shares with the authority that thus unjustly lent its support.

Freedom of enterprise was from the beginning not altogether a blessing. As the liberty to work or to starve, it spelled toil, insecurity, and fear for the vast majority of the population. If the individual were no longer compelled to prove himself on the market, as a free economic subject, the disappearance of this freedom would be one of the greatest achievements of civilization.

Start by scrapping the tax code. Don't fiddle with it. Junk it. Throw it out. Bury it. Replace it with a pro-growth, pro-family tax cut that lowers tax rates to 17% across the board and expands exemptions for individuals and children so that a family of four would pay no taxes on the first $36,000 of income.

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

The quickest and surest way to production, prosperity, and economic growth is through private enterprise. The best way for governments to encourage private enterprise is to establish justice, to enforce contracts, to insure domestic peace and tranquility, to protect private property, and to secure the blessings of liberty including economic liberty - which means to stop putting obstacles in the way of private enterprise.