A Quote by Alex Berenson

Corporate executives often buy or sell shares in their companies, and stocks rarely rise or fall significantly when those transactions are reported.

Related Quotes

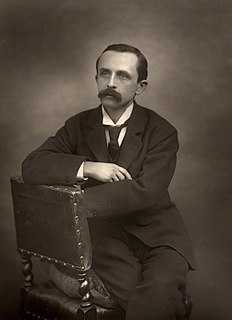

Mr. Darling used to boast to Wendy that her mother not only loved him but respected him. He was one of those deep ones who know about stocks and shares. Of course no one really knows, but he quite seemed to know, and he often said stocks were up and shares were down in a way that would have made any woman respect him.

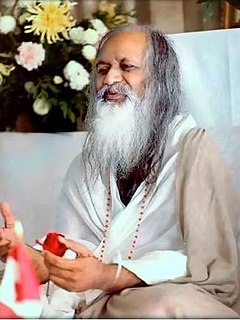

The world has witnessed the rise and fall of monarchy, the rise and fall of dictatorship, the rise and fall of feudalism, the rise and fall of communism, and the rise of democracy; and now we are witnessing the fall of democracy... the theme of the evolution of life continues, sweeping away with it all that does not blossom into perfection.

When you buy enough stocks to give you control of a target company, that's called mergers and acquisitions or corporate raiding. Hedge funds have been doing this, as well as corporate financial managers. With borrowed money you can take over or raid a foreign company too. So, you're having a monopolistic consolidation process that's pushed up the market, because in order to buy a company or arrange a merger, you have to offer more than the going stock-market price. You have to convince existing holders of a stock to sell out to you by paying them more than they'd otherwise get.

When I received the Nobel Prize, the only big lump sum of money I have ever seen, I had to do something with it. The easiest way to drop this hot potato was to invest it, to buy shares. I knew that World War II was coming and I was afraid that if I had shares which rise in case of war, I would wish for war. So I asked my agent to buy shares which go down in the event of war. This he did. I lost my money and saved my soul.

If you expect to be a net saver during the next 5 years, should you hope for a higher or lower stock market during that period? Many investors get this one wrong. Even though they are going to be net buyers of stocks for many years to come, they are elated when stock prices rise and depressed when they fall. This reaction makes no sense. Only those who will be sellers of equities in the near future should be happy at seeing stocks rise. Prospective purchasers should much prefer sinking prices.