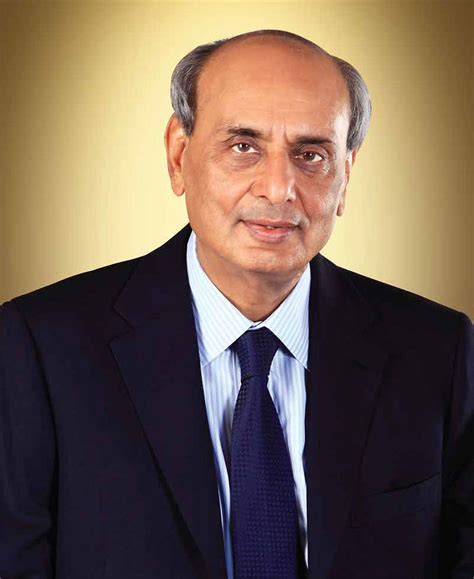

A Quote by Arnon Milchan

I have a responsibility to banks, to shareholders.

Quote Topics

Related Quotes

Corporate social responsibility is measured in terms of businesses improving conditions for their employees, shareholders, communities, and environment. But moral responsibility goes further, reflecting the need for corporations to address fundamental ethical issues such as inclusion, dignity, and equality.

Shareholders are sort of like cats; they get herded around, and they follow the leader. With the exception of a few activist shareholders, there are a very rare number of big, important, influential shareholders that like to step up and say there's a problem here, especially when they're making money.

If the big banks expect to buy influence when they give money to favored think tanks, then the public has a right to know. If the big banks don't expect to buy influence and are merely making charitable contributions, then their shareholders have a right to know. Either way, there's no excuse for keeping these payments secret.

I know different ways of looking at things. I have my stockholders, and I feel a very keen responsibility to the shareholders, but I feel that the main responsibility I have to them is to have the stock appreciate. And you only have it appreciate by reinvesting as much as you can back in the business. And that's what we've done... and that has been my philosophy on running the business.