A Quote by Benjamin Graham

Related Quotes

The moralist and the revolutionary are constantly undermining one another. Marx exploded a hundred tons of dynamite beneath the moralist position, and we are still living in the echo of that tremendous crash. But already, somewhere or other, the sappers are at work and fresh dynamite is being tamped in place to blow Marx at the moon. Then Marx, or somebody like him, will come back with yet more dynamite, and so the process continues, to an end we cannot foresee.

The good thing about the dividend-paying stocks is, first of all you have stocks, which are real assets if we have some inflation. I think we're going to have 2%, 3% maybe 4%. That's a sweet spot for stocks. Corporations do well with that. It gives them pricing power. Their assets move up with prices. I'm not fearful of that inflation.

For all your long-term investments, such as retirement accounts that you won't touch for at least ten years, you need a mix of stocks and bonds. Stocks offer the best shot at inflation-beating gains. But stocks don't always go up. That's where bonds come into play: They have less upside potential, but they also do not pack the same risk.

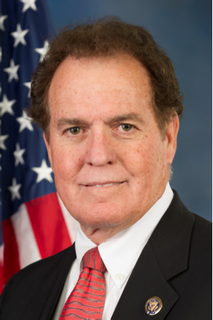

For the life of me, I can't understand why BP couldn't go in at the ocean floor, maybe 10 feet lateral to the - around the periphery, drill a few holes, and put a little ammonium nitrate, some dynamite, in those holes and detonate that dynamite and seal that - seal that leak. And seal it permanently.