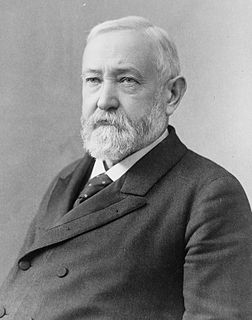

A Quote by Benjamin Graham

Always remember that market quotations are there for convenience, either to be taken advantage of or to be ignored.

Quote Topics

Related Quotes

The investor with a portfolio of sound stocks should expect their prices to fluctuate and should neither be concerned by sizable declines nor become excited by sizable advances. He should always remember that market quotations are there for his convenience, either to be taken advantage of or to be ignored.

High fidelity is a rich experience, and you'll put up with terrible convenience to get it - maybe it's high cost, waiting in line, jumping through hoops. High convenience is the opposite - it's a commodity, but it's cheap and easy and ubiquitous. A great exclusive boutique shop is high fidelity; Wal-Mart is high convenience. Both are hard to establish in their own way. The thing to remember about sustaining either is that you can't sit still. Some other entity will always find a way to challenge your fidelity position or your convenience position.

If you spot a market where the only choices are at either one end or the other - high fidelity or high convenience - there's probably a big opportunity at the other end. That was the opening for Federal Express, for instance. When it started, there was only one mail service in America - the US Postal Service, which was high convenience. Fred Smith created a high-fidelity mail service.

If the educated and influential classes in a community either practice or connive at the systematic violation of laws that seem to them to cross their convenience, what can they expect when the lesson that convenience or a supposed class interest is a sufficient cause for lawlessness has been well learned by the ignorant classes?

Treatment of the apparently whimsical fluctuations of the stock quotations as truly non stationary processes requires a model of such complexity that its practical value is likely to be limited. An additional complication, not encompassed by most stock market models, arises from the manifestation of the market as a nonzero sum game.