Цитата Бенджамина Грэма

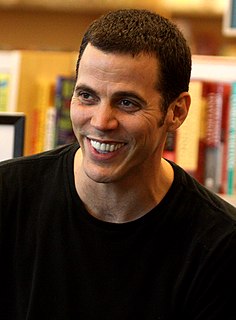

На финансовых рынках задним числом всегда остается 20/20, но предусмотрительность юридически слепа. Таким образом, для большинства инвесторов определение времени выхода на рынок является практически и эмоционально невозможным.

Связанные цитаты

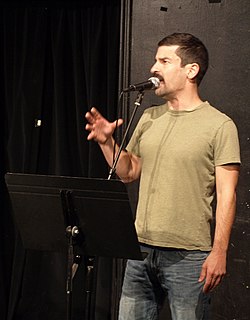

Реальность выглядит гораздо более очевидной в ретроспективе, чем в предвидении. Люди, которые испытывают предубеждение задним числом, ошибочно применяют текущее задним числом к прошлому предвидению. Они воспринимают произошедшие события как более предсказуемые до того, как они произошли, чем это было на самом деле.

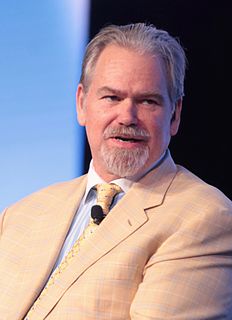

Как стоимостные инвесторы, наш бизнес заключается в том, чтобы покупать сделки, которые, согласно теории финансового рынка, не существуют. В течение четверти века мы приносили нашим клиентам большие доходы: доллар, вложенный в наш крупнейший фонд с самого начала, теперь стоит более 94 долларов, что составляет 20% чистого совокупного дохода. Мы добились этого не за счет высокого риска, как предполагает финансовая теория, а за счет сознательного избегания или хеджирования выявленных нами рисков.

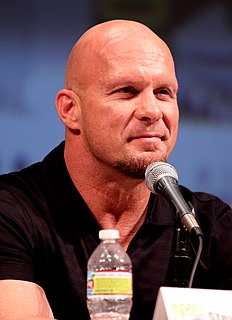

Успешные инвесторы, как правило, бесстрастны, позволяя жадности и страху других играть им на руку. Уверенные в собственном анализе и суждениях, они реагируют на рыночные силы не слепыми эмоциями, а расчетливым разумом. Успешные инвесторы, например, проявляют осторожность на бурных рынках и непоколебимую убежденность на панике. Действительно, то, как инвестор смотрит на рынок и колебания его цен, является ключевым фактором его или ее окончательного инвестиционного успеха или неудачи.