A Quote by Bill Gates

You have the refugee crisis triggered by Syria. That's got a lot of costs associated with it. Domestically, budgets are incredibly tight because the economy's not generating the growth that makes for easy trade-offs.

Related Quotes

We've been talking about the Syrian refugee crisis a lot, in the news in the U.K. and possibly the U.S., but it isn't the only refugee crisis that is happening at this minute. There's something like 22 million refugees in the world. There are people from Eritrea, Afghanistan, Syria, and so many other places where people are living in complete turmoil.

The impact of QE on generating more lending by Wall Street to Main Street and in generating more employment and increasing overall investment in the economy is quite modest. QE probably limited the initial collapse of the economy in 2008, and likely had a very small positive impact on economic growth, but its broader impact on jobs and growth in the economy seems not very big.

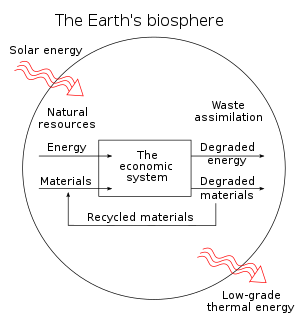

Growth is the mantra of our society because the economy can't remain healthy without growth.Impregnable monopolies aside (and these are few), profits are both the hallmark of capitalism and its Achilles heel, for no business can permanently maintain its prices much above its costs. There is only one way in which profits can be perpetuated; a business-or an entire economy-must grow.

The Fed has a lot of power in the economy because it has a big impact on the supply and cost of credit, that is, interest rates. It also plays a key role in supervising banks and historically has seemed to take it easy on the banks when it shouldn't have, such as in the lead up to the financial crisis.

Consider in Washington, around the country today we are talking about balanced budgets, paying down our national debt, getting the economy going, defending ourselves, activist judges. Newt Gingrich did all those things when he was speaker. We got tax relief. We got balanced budgets. We got, you know, job creation. We paid down our national debt.

Even if we could grow our way out of the crisis and delay the inevitable and painful reconciliation of virtual and real wealth, there is the question of whether this would be a wise thing to do. Marginal costs of additional growth in rich countries, such as global warming, biodiversity loss and roadways choked with cars, now likely exceed marginal benefits of a little extra consumption. The end result is that promoting further economic growth makes us poorer, not richer.

When I was in government, the South African economy was growing at 4.5% - 5%. But then came the global financial crisis of 2008/2009, and so the global economy shrunk. That hit South Africa very hard, because then the export markets shrunk, and that includes China, which has become one of the main trade partners with South Africa. Also, the slowdown in the Chinese economy affected South Africa. The result was that during that whole period, South Africa lost something like a million jobs because of external factors.

Obviously, consideration of costs is key, including opportunity costs. Of course capital isn't free. It's easy to figure out your cost of borrowing, but theorists went bonkers on the cost of equity capital. They say that if you're generating a 100% return on capital, then you shouldn't invest in something that generates an 80% return on capital. It's crazy.

We raised the matter of an agreement that was reached at the Growth and Development Summit, which was that we should access a certain part, 5% was mentioned, of the funds in the hands of the institutional investors, domestically, for investment in the real economy. That being an agreement of the Growth and Development Summit, we will engage South African business to see how we can make that a practical thing. So, there is a different set of engagement with local business.