A Quote by Bill Maris

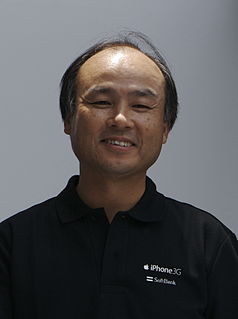

During the 2000 bubble, many companies rushed to go public before they had any revenue.

Related Quotes

The enthusiasm for Tesla and other bubble-basket stocks is reminiscent of the March 2000 dot-com bubble. As was the case then, the bulls rejected conventional valuation methods for a handful of stocks that seemingly could only go up. While we don't know exactly when the bubble will pop, it eventually will.

You can go back to tulip bulbs in Holland 400 years ago. The human beings going through combinations of fear and greed and all of that sort of thing, their behavior can lead to bubbles. And it may have had and Internet bubble at one time, you've had a farm bubble, farmland bubble in the Midwest which resulted in all kinds of tragedy in the early '80s.

Many financial and industrial companies have been bailed out with the public's money, but very few of those who had run those companies have been punished for their failures. Yes, the top managers of those companies have lost their jobs - but with a fat pension and mostly with a handsome severance payment.

Both ground- rents and the ordinary rent of land are a species of revenue which the owner, in many cases, enjoys without any care or attention of his own. The annual produce of the land and labour of the society, the real wealth and revenue of the great body of the people, might be the same after such a tax as before. Ground-rents, and the ordinary rent of land are, therefore, perhaps the species of revenue which can best bear to have a peculiar tax imposed upon them.

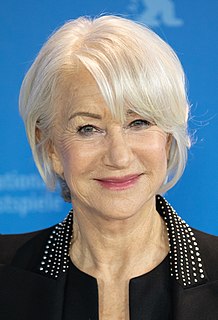

I've not won different awards - many, many times - so luckily I've practiced that whenever you are nominated for anything, you enter into this marvelous, fantabulous bubble called the bubble of nomination. The minute the envelope is opened and your name isn't called out, the bubble bursts. And no one calls you up the next day to say, 'So sorry you didn't win,' or 'You looked gorgeous - nothing. If you win, you get about another 24 hours in that lovely bubble and then - pop - you are slightly wet all over from the bubble and realize that you have to get on with real life.