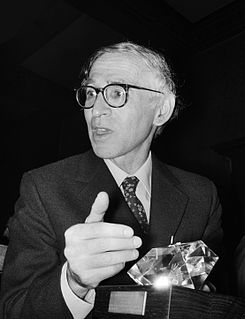

A Quote by Bill Moyers

I report the assault on nature evidenced in coal mining that tears the tops off mountains and dumps them into rivers, sacrificing the health and lives of those in the river valleys to short-term profit, and I see a link between that process and the stock-market frenzy which scorns long-term investments-genuine savings-in favor of quick turnovers and speculative bubbles whose inevitable bursting leaves insiders with stuffed pockets and millions of small stockholders, pensioners, and employees out of work, out of luck, and out of hope.

Quote Topics

Assault

Between

Bubbles

Bursting

Coal

Coal Mining

Employees

Favor

Frenzy

Genuine

Health

Hope

Inevitable

Insiders

Investments

Leaves

Link

Lives

Long

Long-Term

Luck

Market

Millions

Mining

Mountains

Nature

Off

Out

Pockets

Process

Profit

Quick

Report

River

Rivers

Savings

See

Short

Short-Term

Small

Speculative

Stock

Stuffed

Tears

Term

Them

Those

Tops

Valleys

Which

Whose

Work

Related Quotes

Over the long term, despite significant drops from time to time, stocks (especially an intelligently selected stock portfolio) will be one of your best investment options. The trick is to GET to the long term. Think in terms of 5 years, 10 years and longer. Do your planning and asset allocation ahead of time. Choose a portion of your assets to invest in the stock market - and stick with it! Yes, the bad times will come, but over the truly long term, the good times will win out - and I hope the lessons from 2008 will help get you there to enjoy them.

I mean, these good folks are revolutionizing how businesses conduct their business. And, like them, I am very optimistic about our position in the world and about its influence on the United States. We're concerned about the short-term economic news, but long-term I'm optimistic. And so, I hope investors, you know - secondly, I hope investors hold investments for periods of time - that I've always found the best investments are those that you salt away based on economics.

The most important thing that a company can do in the midst of this economic turmoil is to not lose sight of the long-term perspective. Don't confuse the short-term crises with the long-term trends. Amidst all of these short-term change are some fundamental structural transformations happening in the economy, and the best way to stay in business is to not allow the short-term distractions to cause you to ignore what is happening in the long term.

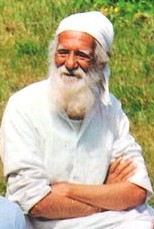

We in Himalaya are facing a crisis of survival due to the suicidal activities being carried out in the name of development… The monstrous Tehri dam is a symbol of this… There is need for a new and long-term policy to protect the dying Himalaya. I do not want to see the death of the most sacred river of the world-the Ganga- for short-term economic gains.

We need a federal government commission to study the way our financial services system is working - I believe it is working badly - and we also need more educated investors. There are good long term low-priced mutual funds - my favorite is a total stock market index fund - and bad short term highly priced mutual funds. If investors would get themselves educated, and invest in the former - taking their money out of the latter - we would see some automatic improvements in the system, and see them fairly quickly.

The most self-disciplined people in the world aren't born with it, but at one point they start to think differently about self discipline. Easy, short-term choices lead to different long-term consequences. Difficult short-term choices lead to easy long-term consequences. What we thought was the easy way led to a much more difficult life. I think that motivation is sort of like a unicorn that people chance like a magic pill that will make them suddenly want to work hard. It's not out there.

Financial institutions are not being bailed out as a favor to them or their stockholders. In fact, stockholders have come out worse off after some bailouts. The real point is to avoid a major contraction of credit that could cause major downturns in output and employment, ruining millions of people, far beyond the financial institutions involved. If it was just a question of the financial institutions themselves, they could be left to sink or swim. But it is not.