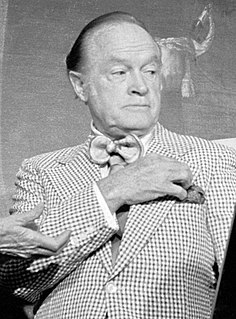

A Quote by Bob Hope

I have the perfect simplified tax form for government. Why don't they just print our money with a return address on it?

Related Quotes

Let's talk about how to fill out your 1984 tax return. Here's an often overlooked accounting technique that can save you thousands of dollars: For several days before you put it in the mail, carry your tax return around under your armpit. No IRS agent is going to want to spend hours poring over a sweat-stained document. So even if you owe money, you can put in for an enormous refund and the agent will probably give it to you, just to avoid an audit. What does he care? It's not his money.

As for loving woman, I have never understood why some people had a fit. I still don't. It seems fine to me. If an individual is productive responsible, and energetic, why should her choice in a partner make such a fuss? The government is only too happy to take my tax money and yet they uphold legislation that keeps me a second class citizen. Surely, there should be a tax break for those of us who are robbed of full and equal participation and protection in the life of our nation.

And I just think that we're at a point in our economic life here in our state - and - and, candidly, across the country, where increased taxes is just the wrong way to go. The people of our state are not convinced that state government, county government, local government has done all they can with the money we already give them, rather than the money that we have...

Strictly speaking, it probably is not “necessary” for the federal government to tax anyone directly; it could simply print the money it needs. However, that would be too bold a stroke, for it would then be obvious to all what kind of counterfeiting operation the government is running. The present system combining taxation and inflation is akin to watering the milk; too much water and the people catch on.

Our federal government, which was intended to operate as a very limited constitutional republic, has instead become a virtually socialist leviathan that redistributes trillions of dollars. We can hardly be surprised when countless special interests fight for the money. The only true solution to the campaign money problem is a return to a proper constitutional government that does not control the economy. Big government and big campaign money go hand-in-hand.

One of the tax systems in the US is for wage earners. The government takes money from them out of each paycheck - so it knows how much they make, and those workers can't cheat to any significant degree. But the other tax system is for capital. Those with capital get to tell the government what they want to tell. They may get audited, but if their tax returns are of any size the government doesn't have enough of the smart auditors to figure out what's really going on. And there are the rules that allow you to do things like take in money today and pay taxes on it thirty years from now.

As bank customers, we tend to believe that we can have both perfect security for our money, drawing on it whenever we want and never expecting it not to be there, while still earning a regular rate of return. In a true free market, however, there tends to be a tradeoff: you can enjoy a money warehouse or you can hope for a return on your investment. You can't usually have both. The Fed, however, by backing up this fractional-reserve system with a promise of endless bailouts and money creation, attempts to keep the illusion going.