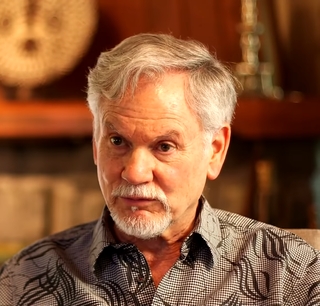

A Quote by Brad Feld

Governments spend all their time trying to get big companies to relocate their headquarters, and they end up subsidizing the move with tax breaks. And companies that relocate their headquarters are often not meaningful job creators.

Related Quotes

People who get higher pay are more willing to relocate--especially to undesirable locations at the company's behest... A corporate secretary may change companies in the same town; a corporate executive is more likely to change towns with the same company. A talented corporate secretary sees an invitation to relocate as an invitation; a future corporate executive sees an invitation to relocate as an opportunity--and an obligation.

We've got a tax code that is encouraging flight of jobs and outsourcing. And that's why we've specifically recommended in this campaign that Congress change our tax code so that we stop giving tax breaks to companies that are moving to Mexico and China and other places, and start putting those tax breaks into companies that are investing here in the United States.

I kind of work on an airplane. The Burger King brand headquarters is in Miami. The Tim's headquarters and our head office is in Toronto. And we have international offices for the brands in Switzerland and Singapore, so I kind of bop back and forth around all the offices. And I try to spend most of my time visiting our restaurant owners.

Many liberals argue that big U.S. companies don't really pay the top corporate rate. While this is sometimes true, it's mainly because, during recessions, companies lose money, and get a tax loss carryforward that temporarily reduces their effective rate. But during economic expansions, when profits rise, companies then do pay the top rate.

When the trust is high, you get the trust dividend. Investors invest in brands people trust. Consumers buy more from companies they trust, they spend more with companies they trust, they recommend companies they trust, and they give companies they trust the benefit of the doubt when things go wrong.