A Quote by Bruce Kovner

The first rule of trading - there are probably many first rules - is don't get caught in a situation in which you can lose a great deal of money for reasons you don't understand.

Related Quotes

Warren Buffett likes to say that the first rule of investing is "Don't lose money," and the second rule is, "Never forget the first rule." I too believe that avoiding loss should be the primary goal of every investor. This does not mean that investors should never incur the risk of any loss at all. Rather "don't lose money" means that over several years an investment portfolio should not be exposed to appreciable loss of principal.

There are many reasons why the general public doesn't really understand our monetary system. In the first place, money is something that people tend to get emotional about. After all, money involves, and always has involved, something closely akin to faith-which probably explains why in many past societies the money system has been in the hands of a priesthood, the subject of magical rites, and the ceremonial services of the tribe's medicine man.

When I first began studying philosophy, a good deal of what went on in analytic epistemology was focused on addressing the Gettier problem. At first, I became quite caught up in it, and the kind of analytical ingenuity required for the work appealed to me. After a while, however, I started to lose interest.

In my view, philosophers have shown a great deal more respect for the first-person point of view than it deserves. There's a lot of empirical work on the various psychological mechanisms by way of which the first-person point of view is produced, and, when we understand this, I believe, we can stop romanticising and mythologising the first-person perspective.

Hear me people: We have now to deal with another race - small and feeble when our fathers first met them, but now great and overbearing. Strangely enough they have a mind to till the soil and the love of possession is a disease with them. These people have made many rules that the rich may break but the poor may not. They take their tithes from the poor and weak to support the rich and those who rule.

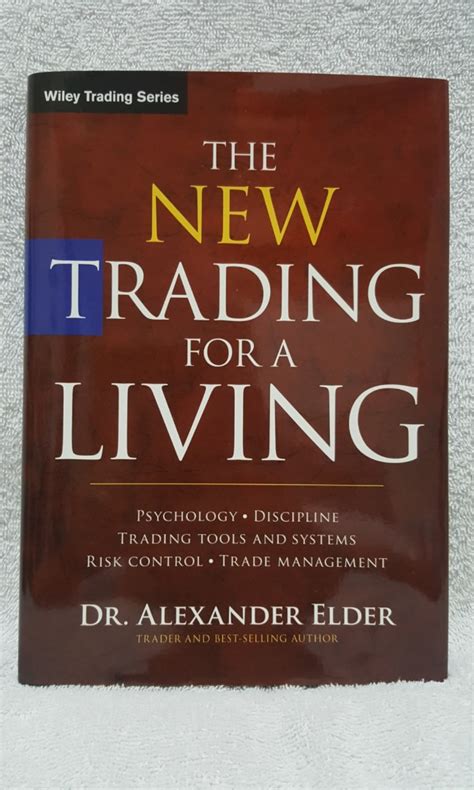

Successful trading depends on the 3M`s - Mind, Method and Money. Beginners focus on analysis, but professionals operate in a three dimensional space. They are aware of trading psychology their own feelings and the mass psychology of the markets. Each trader needs to have a method for choosing specific stocks, options or futures as well as firm rules for pulling the trigger - deciding when to buy and sell. Money refers to how you manage your trading capital.

You must fully understand, strongly believe in, and be totally committed to your trading philosophy. In order to achieve that mental state, you have to do a great deal of independent research. A trading philosophy is something that cannot just be transferred from one person to another; it's something that you have to acquire yourself through time and effort.