A Quote by Harry Browne

I am running for President because it is obvious that no Democrat or Republican is ever going to stop the relentless growth of the federal government. Only a Libertarian will free you from the income tax.

Related Quotes

A tax cut means higher family income and higher business profits and a balanced federal budget....As the national income grows, the federal government will ultimately end up with more revenues. Prosperity is the real way to balance our budget. By lowering tax rates, by increasing jobs and income, we can expand tax revenues and finally bring our budget into balance.

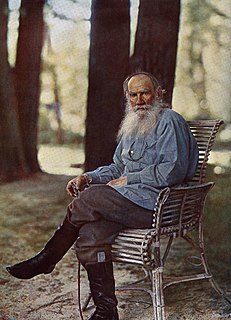

The Founding Fathers realized that "the power to tax is the power to destroy," which is why they did not give the Federal government the power to impose an income tax. Needless to say, the Founders would be horrified to know that Americans today give more than a third of their income to the Federal government.

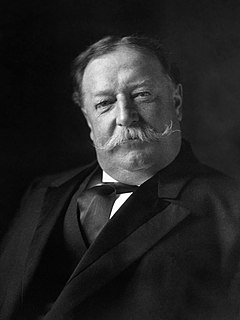

I prefer an income tax, but the truth is I am afraid of the discussion which will follow and the criticism which will ensue if there is an other division in the Supreme Court on the subject of the income tax. Nothing has injured the prestige of the Supreme Court more than that last decision, and I think that many of the most violent advocates of the income tax will be glad of the substitution in their hearts for the same reasons. I am going to push the Constitutional amendment, which will admit an income tax without questions, but I am afraid of it without such an amendment.

When two working people decide to marry, their federal income tax is usually increased. As soon as one spouse earns at least 20 percent of a married couple's total income, the couple pays a 'marriage tax.' ... The United States is the only major industrialized nation in the free world in which the tax cost of the second [married] earner's entry into the work force is higher than that of the first. On one hand, our government's social policy is to help working women earn equal salaries to those of men, but on the other we have a tax structure that penalizes them when they do so.

Republican or Democrat candidate for Presidency ought to say: I look forward to working with the president to solve the problem. People expect us to come here to solve problems. And thus far, the attitude has been: Let's just kind of ignore what the president has said and just hope somebody else comes and solves it for us. And that's what I'd be running on. I'd be running on the economy and I'd be running on national security. But since I'm not running, I can only serve as an adviser to those who are.

Government is taking 40 percent of the GDP. And that's at the state, local and federal level. President Obama has taken government spending at the federal level from 20 percent to 25 percent. Look, at some point, you cease being a free economy, and you become a government economy. And we've got to stop that.

The only reason the president insists on raising [tax] rates is because he knows it will destroy Republican unity, it will cause a complete fracture of the Republican majority in the house, it will hand him a Congress that he can then manipulate for the next two years at least because the Republicans will be neutered. ... This is entirely a political action, a way to get a surrender from the Republicans.

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

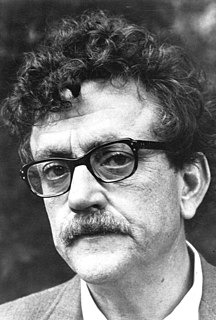

Our federal income tax law defines the tax y to be paid in terms of the income x; it does so in a clumsy enough way by pasting several linear functions together, each valid in another interval or bracket of income. An archeologist who, five thousand years from now, shall unearth some of our income tax returns together with relics of engineering works and mathematical books, will probably date them a couple of centuries earlier, certainly before Galileo and Vieta.

Maybe Donald Trump doesn't want the American people to know that he's paid nothing in federal taxes, because the only years that anybody's ever seen were a couple of years when he had to turn them over to state authorities when he was trying to get a casino license, and they showed he didn't pay any federal income tax.

The real estate lobby has prominent allies in both parties. After the last major overhaul of the tax code, in 1986 - under a Republican president, Ronald Reagan, a Republican Senate and a Democratic House - it was a Democrat, Bill Clinton, who signed legislation that restored lost real estate tax breaks seven years later.