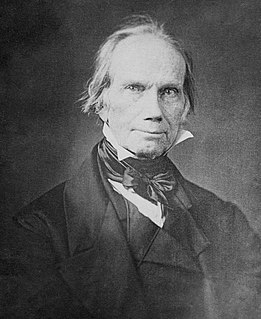

A Quote by Henry Clay

The imposition of taxes has its limits. There is a maximum which cannot be transcended. Suppose the citizen to be taxed by the general government to the utmost extent of his ability, or a thing as much as it can possibly bear, and the state imposes a tax at the same time, which authority is to take it?

Related Quotes

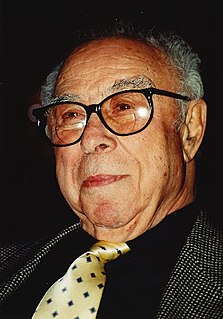

The federal government, state governments will not do without that tax revenue from tobacco no matter what. I've always thought it was one of the most contradictory setups that we have, because everything said publicly about the product is intended to besmirch it, impugn it, and do the same thing to the people that use it. And yet here's the government scoring, I mean, you want to talk about obscene profits, the government doesn't do a damn thing but stick its hand in. The government taxes tobacco at every stage. It taxes tobacco when the farmer's thinking about planting it.

I would like to suggest to you that the extent to which government in America has departed from the original design of in habiting the destructive actions of man and invoking a common justice; the extent to which government has invaded the productive and creative areas; the extent to which the government in this country has assumed the responsibility for the security, welfare, and prosperity of our people is a measure of the extent to which socialism has developed here in this land of ours.

Texas has no income tax, which is a big draw for corporate executives who do business there. But it's hardly tax-free. The property taxes are high for a Southern state. The sales taxes are high. One study found that the bottom 20 percent of the Texas population pays 12 percent of its income in state and local taxes.

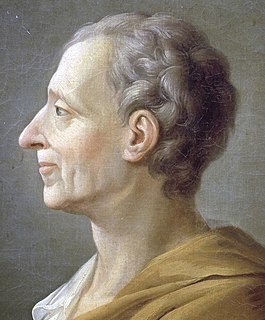

[The taxing power of the state] divides the community into two great classes: one consisting of those who, in reality, pay the taxes and, of course, bear exclusively the burden of supporting the government; and the other, of those who are the recipients of their proceeds through disbursements,and who are, in fact, supported by the government; or, in fewer words, to divide it into tax-payers and tax-consumers. But the effect of this is to place them in antagonistic relations in reference to the fiscal action of the government and the entire course of policy therewith connected.

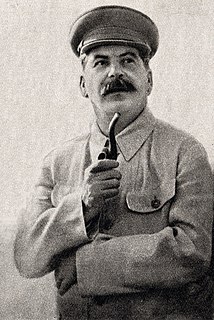

This war is not as in the past; whoever occupies a territory also imposes on it his own social system. Everyone imposes his own system as far as his army can reach. It cannot be otherwise. If now there is not a communist government in Paris, this is only because Russia has no an army which can reach Paris in 1945.

Politicians like to talk about the income tax when they talk about overtaxing the rich, but the income tax is just one part of the total tax system. There are sales taxes, Medicare taxes, social security taxes, unemployment taxes, gasoline taxes, excise taxes - and when you add up all of those taxes [many of which are quite regressive], and then you look at how they affect the rich and the poor, you essentially end up with a system in which the best off 20 percent of Americans pay one percentage point more of their income than the worst off 20 percent of Americans.

Society in every state is a blessing, but government even in its best state is but a necessary evil; in its worst state an intolerable one; for when we suffer, or are exposed to the same miseries by a government, which we might expect in a country without government, our calamity is heightened by reflecting that we furnish the means by which we suffer.

[T]ruly to escape Hegel involves an exact appreciation of the price we have to pay to detach ourselves from him. It assumes that we are aware of the extent to which Hegel, insidiously perhaps, is close to us; it implies a knowledge, in that which permits us to think against Hegel, of that which remains Hegelian. We have to determine the extent to which our anti-Hegelianism is possibly one of his tricks directed against us, at the end of which he stands, motionless, waiting for us.

Surely, it is only when the mind is creatively empty that it is capable of finding out whether there is an ultimate reality or not. But, the mind is never creatively empty; it is always acquiring, always gathering, living on the past or in the future, or trying to be focused in the immediate present: it is never in that state of creativeness in which a new thing can take place. As the mind is a result of time, it cannot possibly understand that which is timeless, eternal.