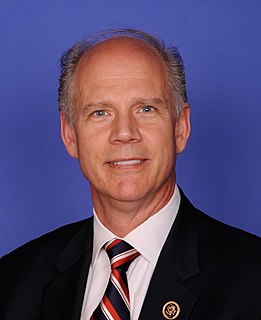

A Quote by Dennis Prager

The more the state gives to its citizens, the less they have to earn. That is the basic concept of the welfare state - you receive almost everything you need without having to earn any of it. About half of Americans now pay no federal income tax - but they receive all government benefits just as if they had paid for, i.e., earned them.

Related Quotes

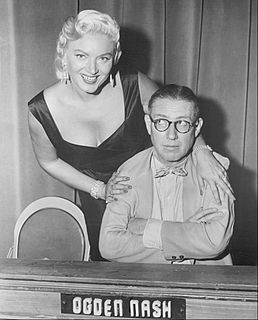

Abracadabra, thus we learn

The more you create, the less you earn.

The less you earn, the more you're given,

The less you lead, the more you're driven,

The more destroyed, the more they feed,

The more you pay, the more they need,

The more you earn, the less you keep,

And now I lay me down to sleep.

I pray the Lord my soul to take

If the tax-collector hasn't got it before I wake.

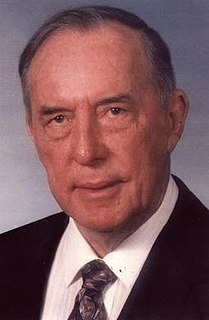

Millions and millions of people don't pay an income tax, because they don't earn enough to pay on one, but you pay a land tax whether it ever did or ever will earn you a penny. You should pay on things that you buy outside of bare necessities. I think this sales tax is the best tax we have had in years.

In the name of short-term stimulus, he [Obama] will give every American family (who makes less than $200,000) a welfare check of $1,000 euphemistically called a refundable tax credit. And he will so sharply cut taxes on the middle class and the poor that the number of Americans who pay no federal income tax will rise from the current one-third of all households to more than half. In the process, he will create a permanent electoral majority that does not pay taxes, but counts on ever-expanding welfare checks from the government.

Maybe Donald Trump doesn't want the American people to know that he's paid nothing in federal taxes, because the only years that anybody's ever seen were a couple of years when he had to turn them over to state authorities when he was trying to get a casino license, and they showed he didn't pay any federal income tax.

Today government touches everything in America and harms almost everything it touches. Federal, state, and local governments together spend 42 out of every 100 dollars we earn. Those who do the taxing and spending have long since ceased to work for the people as a whole. Rather, they work for themselves and for their clients-the education industry, the welfare culture, public-employee unions, etc.

In 2013 Citigroup had profits of $6.4 billion in the United States. They paid no federal income tax and, in fact, received a rebate from the IRS of $260 million. That same year J.P. Morgan had $17.2 billion in profits in the U.S. They also paid no federal income tax. Do you think it's time for tax reform?