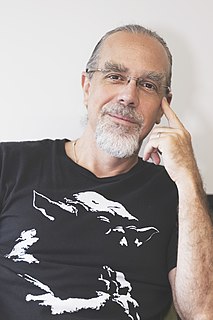

A Quote by Jamais Cascio

The biggest potential and actual crises of the 21st century all have a strong, long, slow aspect with a significant lag between cause and effect. We have to train ourselves to be thinking in terms of longer-term results.

Related Quotes

The most important thing that a company can do in the midst of this economic turmoil is to not lose sight of the long-term perspective. Don't confuse the short-term crises with the long-term trends. Amidst all of these short-term change are some fundamental structural transformations happening in the economy, and the best way to stay in business is to not allow the short-term distractions to cause you to ignore what is happening in the long term.

Over the long term, despite significant drops from time to time, stocks (especially an intelligently selected stock portfolio) will be one of your best investment options. The trick is to GET to the long term. Think in terms of 5 years, 10 years and longer. Do your planning and asset allocation ahead of time. Choose a portion of your assets to invest in the stock market - and stick with it! Yes, the bad times will come, but over the truly long term, the good times will win out - and I hope the lessons from 2008 will help get you there to enjoy them.

At a theoretical level, I think a naturalist approach to religion is just asking questions I'm not interested in. They're perfectly legitimate in their own terms, but they don't address the actual experience of how one or other aspect of religion becomes existentially meaningful to us in our actual lives. The fact that we ourselves are the subject of investigation makes all the difference.

Human intellectual progress, such as it has been, results from our long struggle to see things 'as they are,' or in the most universally comprehensible way, and not as projections of our own emotions. Thunder is not a tantrum in the sky, disease is not a divine punishment, and not every death or accident results from witchcraft. What we call the Enlightenment and hold on to only tenuously, by our fingernails, is the slow-dawning understanding that the world is unfolding according to its own inner algorithms of cause and effect, probability and chance, without any regard for human feelings.

The median family income in the U.S. is lower than it was a quarter-century ago, and if people don't have income, they can't consume, and you can't have a strong economy. There's significant risk - actually it's no longer a risk - a significant likelihood of a marked slowdown not only in China, but also in a lot of other countries like Brazil, which is in recession. All of the other countries that depend on commodities, including Canada, are facing difficulties. So it's hard to see a story of a strong U.S. economy.

Being captive to quarterly earnings isn't consistent with long-term value creation. This pressure and the short term focus of equity markets make it difficult for a public company to invest for long-term success, and tend to force company leaders to sacrifice long-term results to protect current earnings.